# A Comprehensive Guide to Maximizing Rewards Programs

Have you ever wondered how some people always seem to get free flights, hotel stays, or cashback without spending more than you do? The secret isn’t magic—it’s strategic rewards program optimization. Nearly 80% of consumers participate in at least one loyalty program, yet only a fraction truly understand how to maximize their benefits. Most of us collect points haphazardly, missing out on significant value that could be enhancing our lives and stretching our budgets. Whether you’re earning points through credit card spending, retail purchases, or online activities, there’s likely untapped potential in your current approach to rewards. This comprehensive guide will transform how you view, earn, and redeem rewards, turning everyday spending into meaningful benefits that can help you achieve financial goals and enjoy experiences that might otherwise be out of reach.

## Table of Contents

1. Understanding Rewards Programs

2. The Psychology Behind Effective Rewards

3. Maximizing Rewards in Everyday Spending

4. Strategic Credit Card Rewards

5. Retail Loyalty Programs That Deliver Value

6. Travel Rewards Mastery

7. Maximizing Cashback Programs

8. Understanding Point Valuation

9. Smart Redemption Strategies

10. Avoiding Common Rewards Mistakes

11. Frequently Asked Questions

Understanding Rewards Programs

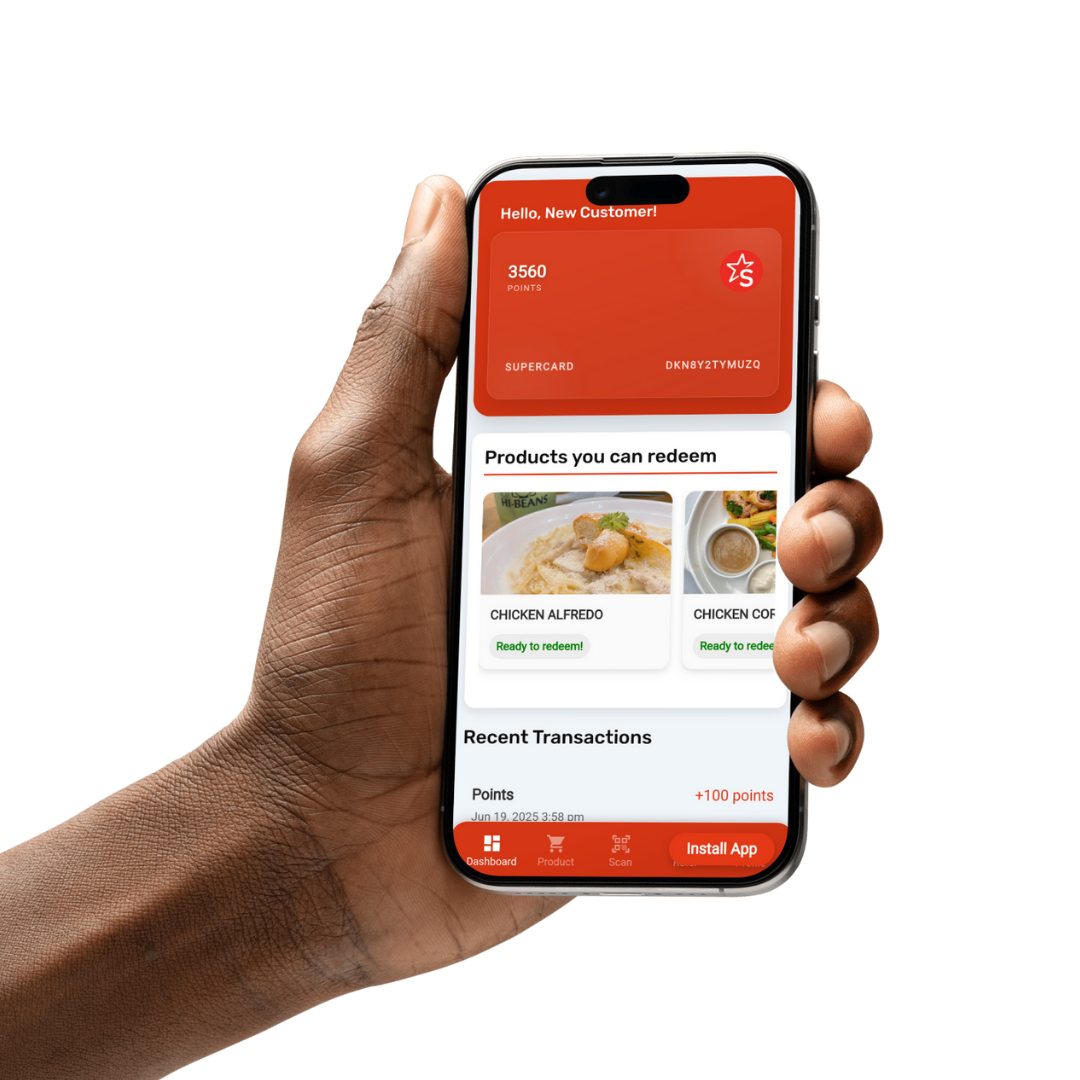

Rewards programs are structured systems designed to incentivize repeat business and customer loyalty through points, miles, or cashback earned on purchases. The fundamental concept dates back to the late 18th century when American retailers began issuing copper tokens that could be redeemed toward future purchases. Today, these programs have evolved into sophisticated ecosystems with an estimated 3.8 billion memberships in the United States alone. The most successful programs create a symbiotic relationship where businesses secure customer loyalty while consumers receive tangible value for their continued patronage. Understanding the different types of programs is crucial—from point-based systems where you accumulate currency redeemable for various products and services to cashback programs that return a percentage of your spending directly to your wallet. Tiered programs offer increasing benefits as you reach higher spending thresholds, while paid programs often provide premium benefits in exchange for an annual fee. Have you ever stopped to consider what type of rewards structure aligns best with your spending habits and lifestyle goals?

Ready to Start Earning Smarter?

Join thousands of savvy consumers who are transforming their spending into valuable rewards. Create your account today and discover how to maximize your everyday purchases!

The Psychology Behind Effective Rewards

The effectiveness of rewards programs isn’t accidental—it’s rooted in fundamental psychological principles that drive human behavior. Variable ratio reinforcement, the same psychological mechanism that makes slot machines addictive, is at play when you earn random bonus points or surprise rewards. This unpredictability creates anticipation and excitement, encouraging continued engagement with the program. The endowment effect explains why we value points we’ve earned more highly than their actual cash value, making us reluctant to leave programs where we’ve accumulated balances. Status and recognition play significant roles in tiered programs, where achieving elite status triggers our desire for social standing and exclusive benefits. Interestingly, studies show that the pain of paying is reduced when using points instead of cash, leading to more enjoyment from redeemed experiences. Programs that offer choice in redemption options activate our preference for autonomy, increasing perceived value. How might these psychological factors be influencing your decisions within rewards programs without your conscious awareness?

Maximizing Rewards in Everyday Spending

Transforming routine purchases into rewarding opportunities requires strategy rather than additional spending. Begin by conducting a spending audit to identify where your money goes each month—categories like groceries, gas, utilities, and dining out typically offer rich rewards potential. Stack your rewards by using shopping portals that offer additional points when accessing retailers through their platform, then paying with a rewards credit card, and finally scanning your loyalty card at checkout. This triple-dipping approach can accelerate your earnings by 5-10 times compared to single-method earning. Set calendar reminders for limited-time bonus categories that rotate quarterly on many credit cards, ensuring you never miss elevated earning opportunities. Utilize apps that track price protection and offer additional cashback on everyday purchases you’re already making. Remember to link your credit cards to dining programs that automatically earn bonus points when you eat at participating restaurants. Have you considered how much value you’re leaving on the table by not optimizing these everyday spending categories?

Strategic Credit Card Rewards

Credit card rewards represent the most lucrative opportunity for points accumulation when approached strategically. The first step involves selecting cards that align with your spending patterns—a travel enthusiast might prioritize airline co-branded cards, while a family focused on household expenses might benefit more from a grocery-focused rewards card. Welcome bonuses offer the fastest path to significant points accumulation, with many cards offering $500-$1000+ in value for meeting minimum spending requirements within the first few months. Premium cards with annual fees often provide valuable credits for travel, dining, or rideshares that can effectively offset the cost when used strategically. Consider implementing a wallet rotation system where you use different cards for different spending categories to maximize earning rates across all purchases. For those with excellent credit, applying for multiple cards strategically can accelerate points earning while minimizing impact on credit scores through proper timing and management. Have you evaluated whether your current credit card lineup truly optimizes your rewards potential?

Unlock Premium Rewards Potential

Ready to take your rewards strategy to the next level? Register for our advanced rewards platform and access exclusive earning opportunities and redemption options!

Retail Loyalty Programs That Deliver Value

Beyond credit cards, retail loyalty programs offer substantial value for frequent shoppers who understand how to maximize their benefits. The most successful retail programs combine instant savings with long-term points accumulation, creating both immediate and delayed gratification. Target’s Circle program, for example, offers personalized discounts alongside 1% back on all purchases, while Amazon Prime members access exclusive deals alongside credit earnings on many purchases. The key to retail rewards success lies in concentration—rather than joining every program, focus on 3-5 retailers where you naturally spend significant amounts annually. Download retailer apps to access mobile-exclusive offers and digital coupons that stack with physical loyalty cards. Time large purchases around bonus point events or special shopping days when many programs offer 5-10x points on spending. For programs with points expiration, set reminders to use your balances before they vanish. Have you evaluated which retail programs actually deliver tangible value versus simply cluttering your wallet with rarely-used cards?

Travel Rewards Mastery

Travel rewards represent the holy grail for many points enthusiasts, offering the potential for luxurious experiences that might otherwise be unaffordable. The travel rewards landscape divides into two primary categories: flexible points currencies like Chase Ultimate Rewards or American Express Membership Rewards, and airline/hotel-specific programs. Flexible points typically offer superior redemption value when transferred to airline and hotel partners during promotional periods, sometimes increasing value by 30-50% compared to direct redemption. Airline programs require understanding award charts, partner airlines, and sweet spots where points deliver exceptional value—such as international business class flights that would cost thousands of cash dollars. Hotel programs increasingly offer valuable perks like room upgrades, late checkout, and breakfast for elite status members. The savviest travelers leverage credit card benefits like airport lounge access, travel insurance, and statement credits to enhance their journey beyond just free flights and rooms. When was the last time you calculated the actual cents-per-point value you’re receiving from your travel redemptions?

Maximizing Cashback Programs

For those who prefer simplicity and flexibility, cashback programs offer straightforward value without complex redemption rules. The most effective cashback strategies involve layering multiple programs to boost returns beyond the standard 1-2%. Start with a flat-rate cashback card that earns 2% on all purchases as your foundation, then add category-specific cards that offer 3-5% on your highest spending areas like groceries, gas, or dining. Browser extensions like Rakuten or Honey provide additional cashback when shopping online at thousands of retailers, often stacking with credit card rewards. Don’t overlook rotating category cards that offer 5% back on different spending categories each quarter—when aligned with your natural spending patterns, these can deliver exceptional value. For those who pay rent or large bills, services that allow credit card payments (often for a small fee) can generate significant cashback when the math makes sense. Have you calculated whether your current cashback approach truly maximizes your return across all spending categories?

Understanding Point Valuation

Not all points are created equal, and understanding valuation is critical to maximizing your rewards strategy. Point valuation refers to the actual cash value each point represents when redeemed optimally—a concept that varies dramatically across programs. Credit card points typically range from 0.5 cents to 2+ cents per point depending on redemption method, with travel transfers often offering the highest value. Airline miles can vary from 1 cent to 10+ cents per mile based on factors like route, class of service, and redemption timing. Hotel points generally fall in the 0.6-1.2 cent range, though premium redemptions can deliver exceptional value. The key to accurate valuation involves tracking what the cash price would be for the same redemption, then dividing that amount by the points required. This calculation reveals your actual return on spending and helps identify the most valuable redemption opportunities. Without understanding point valuation, you might be celebrating a “free” flight that actually delivered poor value for your points. When was the last time you calculated the actual value you’re getting from your rewards redemptions?

Transform Your Spending Into Rewards

Join our community of rewards optimizers and start earning more from your everyday purchases.

Smart Redemption Strategies

Earning points is only half the battle—redemption strategy determines whether you receive mediocre or exceptional value from your rewards. The fundamental rule of redemption is to avoid “point waste” through low-value options like statement credits or gift cards when higher-value opportunities exist. For travel rewards, flexibility is key—being open to different destinations, travel dates, and cabin classes can dramatically increase the value you receive from your points. Learn the art of award searching, which involves understanding airline alliances, partner availability, and booking windows when award space is most plentiful. Consider points pooling through programs that allow transferring points between family members to consolidate balances for more valuable redemptions. For cashback earners, timing redemptions to coincide with large purchases or bill payments can provide meaningful cash flow benefits. The most advanced strategies involve “points currency conversion” where you transfer points between programs during transfer bonuses to effectively increase your points balance by 25-50%. Have you developed a systematic approach to redemption that ensures you’re always extracting maximum value from your hard-earned points?

Avoiding Common Rewards Mistakes

Even experienced rewards enthusiasts can fall into common traps that diminish their earning potential and redemption value. The most frequent mistake is carrying a balance on rewards cards—the interest charges quickly outweigh any points value, effectively negating the benefits. Points dilution occurs when consumers spread their spending across too many programs, preventing them from accumulating meaningful balances in any single program. Another critical error involves allowing points to expire through inactivity—a particular risk with airline programs that often have 18-24 month expiration policies. Many consumers overlook program changes and devaluations, failing to adjust their strategies when programs reduce point values or increase redemption requirements. The “use it or lose it” mentality leads to poor-value redemptions simply because points are available, rather than waiting for optimal opportunities. Finally, many people neglect to consider opportunity cost—the value they’re missing by not using the optimal card for each purchase category. Are any of these common mistakes quietly reducing the effectiveness of your rewards strategy?

Frequently Asked Questions

How many rewards programs should I join?

The optimal number of rewards programs depends entirely on your spending habits and capacity to manage them effectively. Most consumers benefit from 2-3 credit card rewards programs that cover their major spending categories, plus 3-5 retail programs for stores where they shop frequently. The key is concentration rather than proliferation—it’s better to earn meaningful rewards in a few programs than negligible rewards across many. Avoid joining programs for businesses where you rarely shop, as inactive accounts may eventually be closed with points forfeited.

Do rewards programs encourage overspending?

Rewards programs can create psychological incentives to spend more if not managed carefully. The phenomenon known as “points panic” drives unnecessary spending to meet thresholds for welcome bonuses or elite status. However, with discipline, rewards programs simply provide benefits on spending you would have done anyway. The most successful rewards users maintain budgets and spending patterns identical to what they would follow without rewards, treating the points as a bonus rather than a justification for increased consumption.

How do I track multiple rewards programs?

Effective tracking involves using a combination of tools and systems. Password managers securely store login credentials for various programs. Spreadsheets can track points balances, expiration dates, and elite status progress. Apps like AwardWallet automatically track many travel loyalty programs. Set calendar reminders for points expiration dates and limited-time bonus opportunities. The most important aspect is establishing a regular review schedule—perhaps monthly—to assess your points landscape and plan redemptions.

Are rewards programs worth the annual fees?

Annual fees can be well worth the cost when the card’s benefits outweigh the fee. Calculate whether you will use enough of the card’s perks—such as travel credits, lounge access, or bonus categories—to offset the fee. Many premium cards offer hundreds of dollars in annual credits that effectively negate the fee if fully utilized. Consider your spending patterns and whether the enhanced earning rates on your largest categories will generate additional value beyond what a no-fee card would provide.

What happens to my points if a program changes or ends?

Program changes and term modifications are common in the rewards landscape. While points devaluation is always a risk, most programs provide advance notice of significant changes. If a program announces major devaluation, consider whether accelerated redemption makes sense. In cases of program termination, providers typically offer a redemption window before points expire. The best protection against program changes is diversification—spreading your points across multiple programs rather concentrating in one vulnerable currency.

How do I maximize rewards without changing my spending habits?

Maximizing rewards without spending more involves optimization rather than expansion. Begin by ensuring you’re using the right payment method for each spending category based on bonus earnings. Register for shopping portals that offer additional points for online purchases you’re already making. Connect your credit cards to dining programs that automatically earn bonus points at participating restaurants. Finally, ensure you’re not missing any easy earning opportunities like linking your accounts to charity donation programs or using specific payment apps that offer bonus points.

Transforming your approach to rewards programs requires neither excessive spending nor complex financial maneuvers—rather, it demands strategic thinking and consistent habits. The potential value hidden within your everyday transactions represents an untapped resource that could be funding vacations, reducing bills, or providing luxury experiences without additional budget allocation. By understanding program structures, maximizing earning through strategic spending, and implementing smart redemption practices, you can elevate your rewards game from passive participation to active optimization. The journey toward rewards mastery begins with a single step: evaluating your current programs and identifying one area for immediate improvement. Whether that means adjusting which card you use for groceries, setting reminders for points expiration, or finally planning that points-funded vacation, the time to start is now. Your future self will thank you for the experiences and savings gained through smarter rewards management.

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies