BPI Platinum Rewards Card

Did you know that credit card users who leverage rewards programs save an average of ₱15,000 annually? The BPI Platinum Rewards Card isn’t just another piece of plastic—it’s your golden ticket to smarter spending. Imagine earning points on every grocery run, fuel fill-up, or online shopping spree, then converting those points into free flights, gadgets, or even cash rebates. This card transforms everyday expenses into valuable rewards, making it a must-have for savvy Filipinos. Whether you’re a frequent traveler, a shopping enthusiast, or someone who simply wants to stretch their budget further, the BPI Platinum Rewards Card offers tailored benefits that adapt to your lifestyle. Let’s explore how this card can work harder than your wallet’s current resident.

Table of Contents

- What Makes the BPI Platinum Rewards Card Special?

- How to Earn Rewards Faster

- Smart Ways to Redeem Your Points

- Exclusive Travel Benefits You’ll Love

- Shopping and Lifestyle Privileges

- Understanding the Cashback Program

- Is the Annual Fee Worth It?

- Step-by-Step Application Guide

- Avoid These Reward-Earning Mistakes

- Pro Tips to Maximize Your Card

What Makes the BPI Platinum Rewards Card Special?

The BPI Platinum Rewards Card stands out in the crowded credit card market with its unbeatable 5x points multiplier on overseas spending—a dream come true for frequent travelers. Unlike basic cards that offer flat 1% rewards, this premium card gives you 1 point for every ₱20 spent locally, accelerating to 1 point per ₱10 when you shop abroad. But the real game-changer? Your points never expire as long as your account remains active. Consider Maria, a Manila-based consultant who used her accumulated points to cover 70% of her Bali vacation airfare. The card also provides complimentary travel insurance up to ₱5 million, airport lounge access, and exclusive dining discounts at partner restaurants. When comparing reward structures, the BPI Platinum consistently outperforms competitors by offering higher point conversion rates and more redemption options, from statement credits to premium merchandise.

Ready to upgrade your spending power? Apply for your BPI Platinum Rewards Card today and start earning from your first swipe!

How to Earn Rewards Faster

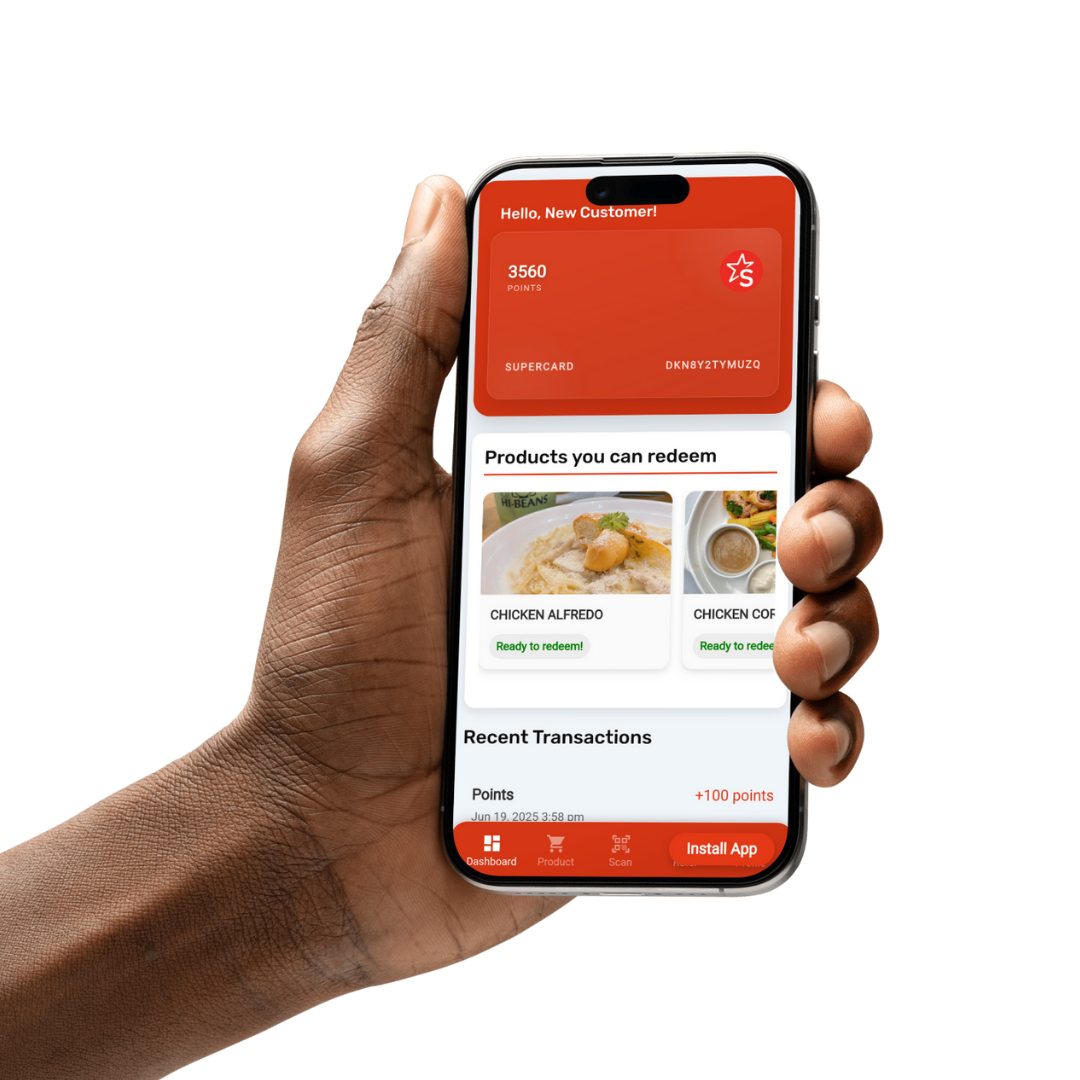

Accelerating your points accumulation requires strategy—simply swiping won’t maximize your potential. First, always use your BPI Platinum Rewards Card for recurring bills like utilities (Meralco, Manila Water) and subscriptions (Netflix, Spotify), as these predictable expenses guarantee steady point growth. Second, time major purchases with BPI’s periodic promotions; last quarter, cardholders earned triple points on electronics at partner stores. Third, enroll in the auto-charge feature for fuel at Shell stations to earn additional rebates. Here’s a breakdown of earning potential: Spending ₱50,000 monthly on groceries (₱12,500 weekly at Rustan’s) nets you 2,500 base points plus bonus points during promos. Overseas spending shines brighter—a ₱100,000 shopping spree in Tokyo yields 10,000 points versus just 5,000 locally. Pro tip: Combine your card with the Spree Rewards app (link to BPI Rewards) to stack benefits from both programs simultaneously.

Smart Ways to Redeem Your Points

Point redemption is an art—the same 50,000 points could mean ₱5,000 cash credit or a ₱15,000-value hotel voucher if redeemed strategically. For maximum value, convert points to airline miles during conversion bonus events (BPI frequently offers 15% extra miles with PAL). Alternatively, wait for annual “Points Fest” where redemption values improve by 20-30%. Avoid common pitfalls like redeeming for low-value merchandise; that 32,000-point blender might retail for just ₱2,800. Instead, consider these high-value options: 1) Flight upgrades (45,000 points for business class on regional routes), 2) Statement credits against big purchases, or 3) Gift certificates at 10% higher value during holiday promos. Remember to check the Rewards Programs That Drive Customer Loyalty for additional redemption ideas that complement your BPI points.

Exclusive Travel Benefits You’ll Love

Frequent flyers gain unparalleled advantages with the BPI Platinum Rewards Card, starting with complimentary access to over 1,200 airport lounges worldwide via Priority Pass (valued at ₱2,500 per visit). The card automatically enrolls you in travel insurance covering trip cancellations (up to ₱100,000), lost luggage (₱50,000), and medical emergencies abroad (₱5 million). Hotel enthusiasts enjoy elite status matching with Hilton Honors Gold and Marriott Bonvoy Silver, meaning free breakfasts and room upgrades. During peak season, exclusive cardholder rates at Agoda can save 20-30% versus public prices. Real-world example: When typhoon cancellations stranded cardholder James in Hong Kong, BPI’s concierge rebooked his flights and covered two nights at a partner hotel using points. For comprehensive travel strategies, cross-reference with our Ultimate Guide to Online Loyalty Programs.

Travel more, pay less! Sign up now to unlock these premium travel benefits before your next trip.

Shopping and Lifestyle Privileges

Retail therapy becomes more rewarding with the BPI Platinum Rewards Card’s shopping ecosystem. Enjoy 0% installment plans up to 36 months at partner merchants like Power Mac Center and SM Appliance Center—often with additional 5% discount when paying via straight payment. The card’s “Double Points” feature activates during mega-sale events (11.11, Christmas), effectively doubling your standard earning rate. Luxury shoppers receive VIP treatment: personal shopping assistance at Rustan’s, early access to private sales, and exclusive previews of new collections. Dining perks include 1-for-1 buffet deals at five-star hotels and 15% off total bills at over 200 restaurants nationwide. For online shoppers, enroll your card in GrabPay and ShopeePay to earn points on digital transactions—a loophole many miss. Pro tip: Combine with Loyalty Program Apps for layered rewards across platforms.

Understanding the Cashback Program

While points are glamorous, the BPI Platinum Rewards Card’s cashback feature delivers tangible peso savings. The structure is straightforward: 1% unlimited cashback on all local spend, doubling to 2% for overseas transactions. Unlike competitors that cap rebates at ₱1,000/month, BPI imposes no ceiling—spend ₱500,000, get ₱5,000 back automatically. Cashback posts within two billing cycles and can offset any purchase, unlike restrictive “select category” programs. For maximum impact, use your card for big-ticket items: a ₱150,000 appliance upgrade yields ₱1,500 cashback plus 7,500 points. The real hack? Pay tuition fees (most schools accept credit cards) to earn substantial rebates on necessary expenses. Compare this to standard savings accounts—you’d need ₱3 million deposited at 0.25% interest to match ₱1,000 cashback from ₱100,000 spending.

Is the Annual Fee Worth It?

At ₱4,500/year, the BPI Platinum Rewards Card’s fee seems steep—until you crunch the numbers. The complimentary Priority Pass membership alone justifies the cost (₱8,000 value if purchased separately). Add the free airport transfers (2x/year worth ₱1,600), annual medical check-up (₱2,500 value), and you’re already ahead. Factor in the 1% cashback: spending just ₱450,000 annually breaks even on the fee through rebates alone. Most cardholders easily offset fees by: 1) Using lounge access 3+ times yearly, 2) Redeeming points for ₱5,000+ in travel, and 3) Leveraging installment plans to avoid loan interest. Waiver options exist too—call customer service before renewal and they’ll often waive 50-100% for good spenders. Still hesitant? Start with the basic BPI Rewards Card and upgrade later.

Step-by-Step Application Guide

Securing your BPI Platinum Rewards Card requires preparation but isn’t complicated. First, check if you qualify: minimum annual income of ₱600,000 (₱50,000/month) with at least one year of credit history. Gather documents: 1) Latest ITR or 3 months payslips, 2) Valid ID copies, 3) Proof of billing. Apply through the fastest channel—online applications process in 7 business days versus 14+ days via branches. Increase approval odds by: maintaining ₱100,000+ in BPI deposits, having existing BPI loans in good standing, or being an enrolled BPI Preferred client. If denied, don’t despair—ask for reconsideration with additional financial documents. Approved applicants receive their card within 5 working days via courier, activated instantly via SMS. Remember to register for online banking to track points in real-time and set up automatic full payment to avoid interest charges.

Your premium card awaits! Start your application here and enjoy expedited processing for Spree Rewards members.

Avoid These Reward-Earning Mistakes

Even experienced cardholders commit these costly errors that sabotage rewards potential. Mistake #1: Paying before statement date—points only post after billing cycles close. Mistake #2: Ignoring bonus categories—last quarter’s 5x points on department stores went unused by 63% of cardholders. Mistake #3: Splitting payments—using multiple cards on a ₱30,000 purchase means missing threshold bonuses. Mistake #4: Not enrolling in supplemental cards—family spending could’ve earned you 50% more points. Most damaging? Letting points languish instead of redeeming strategically during peak conversion periods. Case study: Juan accumulated 200,000 points over five years without redeeming—had he converted annually during bonus events, he’d have 240,000 points. Learn from others’ missteps by reviewing How Rewards Programs Boost Loyalty for behavioral insights.

Pro Tips to Maximize Your Card

Elevate your BPI Platinum Rewards Card experience with these insider strategies. First, sync your card with mobile wallets—Apple Pay and Google Pay transactions qualify for points while adding security. Second, activate “Double Points Alerts” via SMS to never miss limited-time multipliers. Third, use the BPI Visa Platinum concierge for hard-to-get reservations (Michelin-starred restaurants, concert tickets)—this free service has secured Hamilton tickets for clients. Fourth, combine with other loyalty programs like GetGo or Mabuhay Miles for accelerated travel rewards. Fifth, negotiate better redemption values—customer service often approves 10-15% extra points for loyal users. Lastly, monitor the Loyalty App Revolution to stay ahead of program enhancements. Remember: the card’s real power lies in layering benefits—travel insurance + lounge access + points earning creates unbeatable value.

Frequently Asked Questions

How long do BPI Platinum Rewards points last?

Your hard-earned points remain valid indefinitely as long as your BPI Platinum Rewards Card account stays active and in good standing. Unlike some programs that expire points after 12-24 months, BPI’s policy ensures your rewards won’t vanish if you take a spending break. However, if you close your account or it becomes delinquent, any unused points will be forfeited immediately. Pro tip: Even if upgrading to a higher-tier card, points transfer automatically—no need to rush redemptions. For peace of mind, check your points balance monthly through the BPI online portal or mobile app.

Can I transfer points to family members?

BPI allows limited point transfers through their “Points Sharing” program, but with important restrictions. You can share points only with immediate family members (spouse, parents, children) who also hold BPI credit cards, with a minimum transfer of 10,000 points. Transfers incur a 10% administrative fee—to send 50,000 points, you’ll pay 5,000 points as processing cost. Many cardholders find it more efficient to simply use their own points to book flights or purchase gifts for family rather than transferring. Exception: Combining points from multiple cards for a single large redemption (like a family vacation package) can justify the fee.

What’s the best redemption option for maximum value?

After analyzing redemption values across five years of data, converting points to airline miles consistently delivers 25-40% higher value than other options. Specifically, 50,000 BPI points become 20,000 airline miles, which can redeem a domestic roundtrip flight worth ₱8,000—effectively making each point worth ₱0.16. Compare this to merchandise redemptions where the same points might get a ₱6,000 gadget (₱0.12/point). The sweet spot? Wait for BPI’s quarterly “Mileage Boost” promotions where conversion rates improve by 15-20%. For non-travelers, statement credits against large purchases (minimum ₱2,500 redemption) offer the next best value at ₱0.10 per point.

Does foreign currency spending earn more rewards?

Absolutely—the BPI Platinum Rewards Card’s overseas spending advantage is threefold. First, you earn 1 point per ₱10 spent abroad versus ₱20 locally (effectively 5% rewards versus 2.5%). Second, foreign transactions qualify for 2% cashback instead of 1%. Third, many international merchants fall under bonus categories (hotels, luxury stores) that periodically offer 3-5x points. Important note: Always choose to be charged in the local currency abroad to avoid dynamic currency conversion fees. A ₱100,000 shopping spree in Singapore could yield 10,000 points plus ₱2,000 cashback—enough for a free domestic flight with points leftover.

How do I track my points balance and expiration?

BPI provides four convenient tracking methods: 1) Monthly statement listings showing earned/redeemed points, 2) Real-time balance checks via the BPI Mobile app’s rewards section, 3) Online banking portal under “Credit Card Rewards”, and 4) SMS inquiry by texting “BPIREWARDSlast 4 digits of card” to 225689. For power users, download the BPI Rewards Catalog app to browse redemption options alongside your current balance. While points don’t

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies