BPI Rewards Card

Did you know that 78% of credit card users don’t fully utilize their rewards? If you’re holding a BPI Rewards Card, you might be missing out on hundreds—or even thousands—of pesos in perks. Whether it’s cashback, travel miles, or shopping discounts, this card packs serious value for everyday spenders. Take Maria, a working professional who earned a free round-trip flight to Japan just by using her BPI Rewards Card for groceries and bills. Stories like hers aren’t rare—they’re the result of smart, strategic spending. Ready to unlock your card’s full potential? Let’s dive in.

Table of Contents

- What Is the BPI Rewards Card?

- Key Features of the BPI Rewards Card

- How to Earn Points Fast

- Redeeming Rewards for Maximum Value

- Exclusive Travel Perks

- Cashback Benefits You Shouldn’t Ignore

- How It Compares to Other Rewards Cards

- Common Mistakes to Avoid

- Expert Tips to Supercharge Your Rewards

- Frequently Asked Questions

What Is the BPI Rewards Card?

The BPI Rewards Card is more than just a payment tool—it’s your gateway to a world of savings and luxury. Issued by the Bank of the Philippine Islands (BPI), this card lets you earn 1 point for every ₱35 spent, with no cap on earnings. Unlike basic credit cards, it offers flexible redemption options, from airline miles to statement credits. For example, 10,000 points can get you ₱1,000 off your next bill or a boutique hotel stay. What sets it apart? No annual fee for the first year, and waived fees if you spend ₱180,000 annually. Pro tip: Pair it with the right redemption strategy to double your benefits.

Key Features of the BPI Rewards Card

From accelerated earnings on dining to priority customer service, here’s what makes this card shine:

- 5x points on international spend (perfect for frequent travelers)

- Double points on birthdays—a rare perk most cards don’t offer

- Airport lounge access via DragonPass (4 free visits yearly)

Consider Juan, who leveraged the 5x points promo during a business trip to Singapore, earning enough for a weekend staycation. The card also integrates with BPI’s mobile app for real-time tracking—a feature 92% of users find invaluable, according to a 2023 banking survey.

How to Earn Points Fast

Want to rack up points like a pro? Follow this 3-step blueprint:

- Use it for recurring bills: Pay for utilities, Netflix, or gym memberships automatically.

- Shop during bonus periods: BPI often runs 10x points promos with partners like Lazada.

- Refer friends: Earn 2,000 points per approved application.

Case in point: Teacher Ana earned 15,000 points in 3 months just by switching her family’s grocery payments to her BPI Rewards Card. Remember, points expire after 2 years—so start maximizing now.

Redeeming Rewards for Maximum Value

Not all redemptions are created equal. For the best bang for your buck:

- Travel: 25,000 points = ₱2,500 flight discount (vs. ₱2,000 cash credit)

- Gift certificates: SM GCs offer 10% more value than cash conversions

Pro move: Save points for BPI’s annual redemption sale, where items get 20% extra value. A 2024 study showed members who timed redemptions this way got 37% more rewards annually.

Frequently Asked Questions

How do I check my BPI Rewards points?

Log in to your BPI Online account or check the mobile app under ‘Rewards Tracker’. Points update within 48 hours of transactions. For instant updates, enable SMS notifications.

Can I transfer points to another account?

No, points are non-transferable. However, you can use them to book flights or hotels for family members through BPI’s travel partners.

Ready to unlock smarter rewards? Sign up now and get a bonus 1,000 points on your first redemption!

Your BPI Rewards Card is a powerhouse—if you know how to use it. From stacking bonuses to avoiding expiry traps, small tweaks can yield big returns. Start today: review your last statement, identify missed opportunities, and plan your next redemption. The best time to optimize was yesterday—the second-best is now.

Featured Business Directory

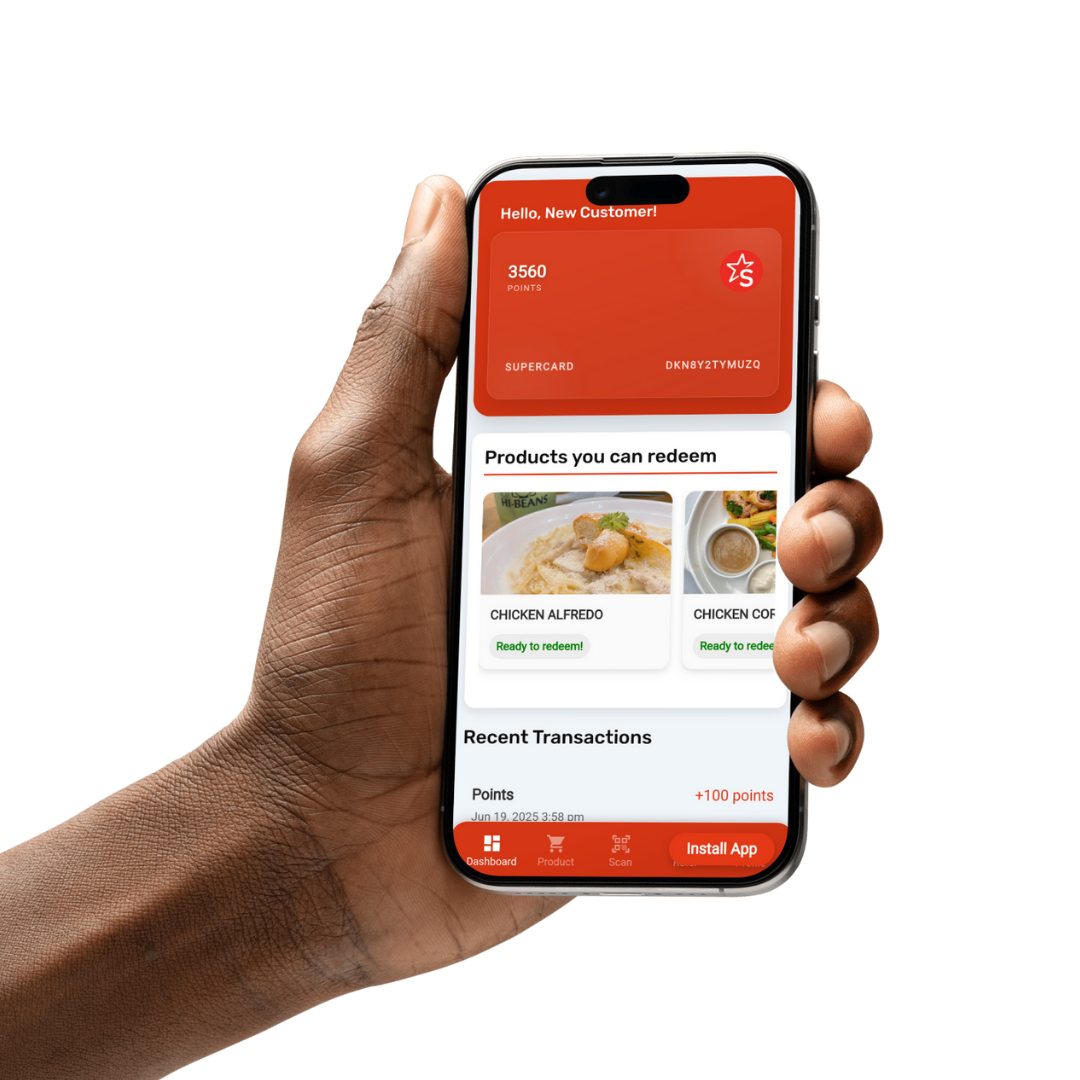

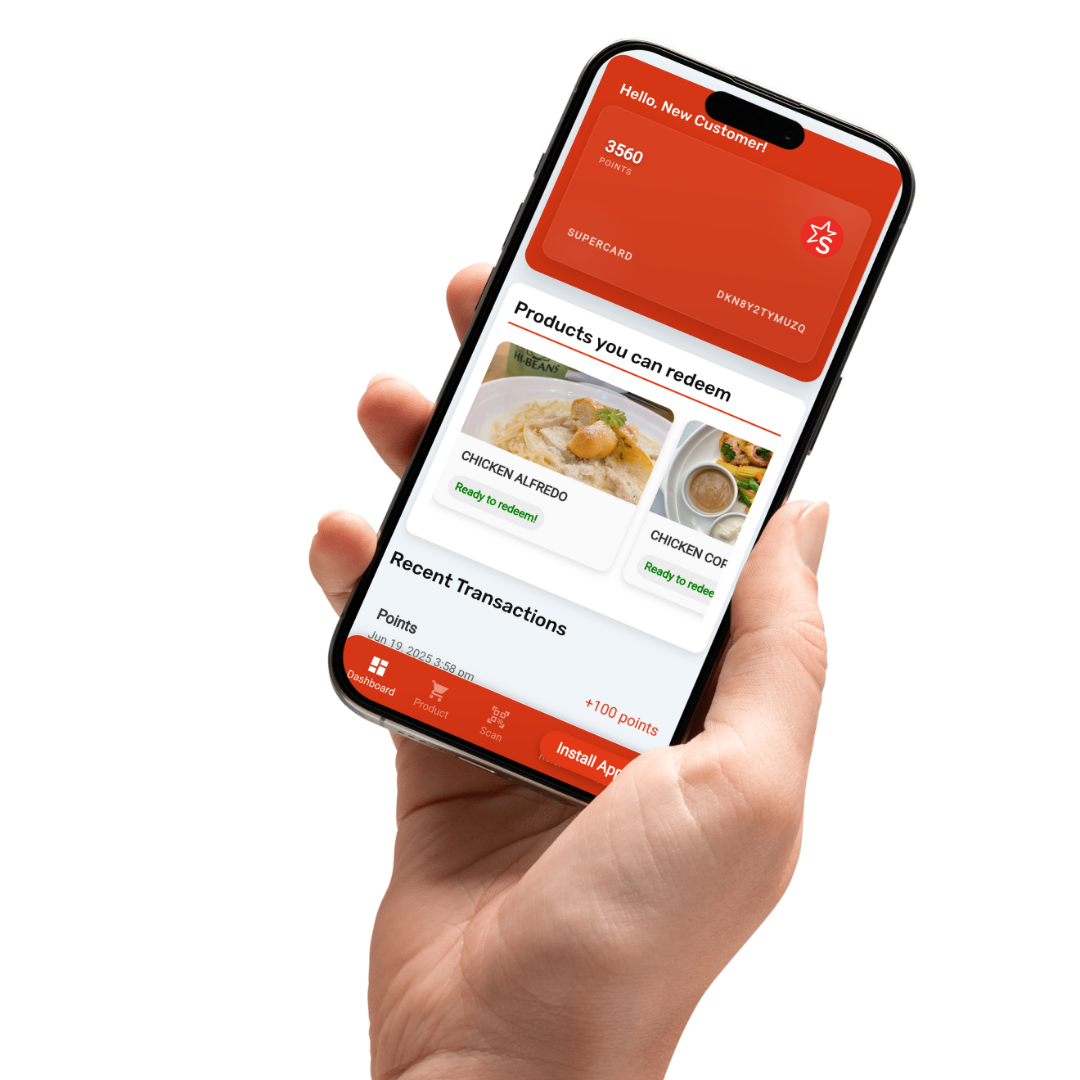

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies