The Loyalty Card Revolution: From Paper Punch Cards to Digital Dominance

Did you know 77% of consumers say loyalty programs make them more likely to stick with brands? Yet here’s the shocking twist – despite 90% of companies having some form of loyalty initiative, a staggering 55% of these programs fail within the first three years. Why? Because most businesses are still using loyalty strategies from the Mad Men era while consumers have moved into the digital age. Imagine this: You’re standing at a coffee shop counter, fumbling through your wallet for that dog-eared punch card that always seems to vanish when you need it most. Meanwhile, the person behind you flashes their phone and instantly redeems rewards through a sleek stamp card app. That tiny moment captures the seismic shift happening in customer loyalty programs today. The humble loyalty card has undergone a digital metamorphosis, evolving from paper rectangles to intelligent systems that know your preferences before you do. This transformation isn’t just convenient – it’s rewriting the rules of customer retention in every industry from neighborhood bakeries to boutique hotels.

Table of Contents

- The Loyalty Card Renaissance: Why Physical Meets Digital

- From S&H Green Stamps to Digital Stamps: A Historical Journey

- The Paper Problem: Why Traditional Punch Cards Fail

- The Ripple Effect: How Digital Loyalty Transforms Businesses

- Implementation Obstacles: Avoiding Digital Loyalty Pitfalls

- Your Digital Transformation Roadmap: Step-by-Step Guide

- Industry Insights: What Loyalty Experts Won’t Tell You

- The Cutting Edge: AI, Gamification & Personalization

- The 2025 Loyalty Landscape: Predictions & Preparations

- Key Takeaways: Your Action Plan for Loyalty Dominance

The Loyalty Card Renaissance: Why Physical Meets Digital

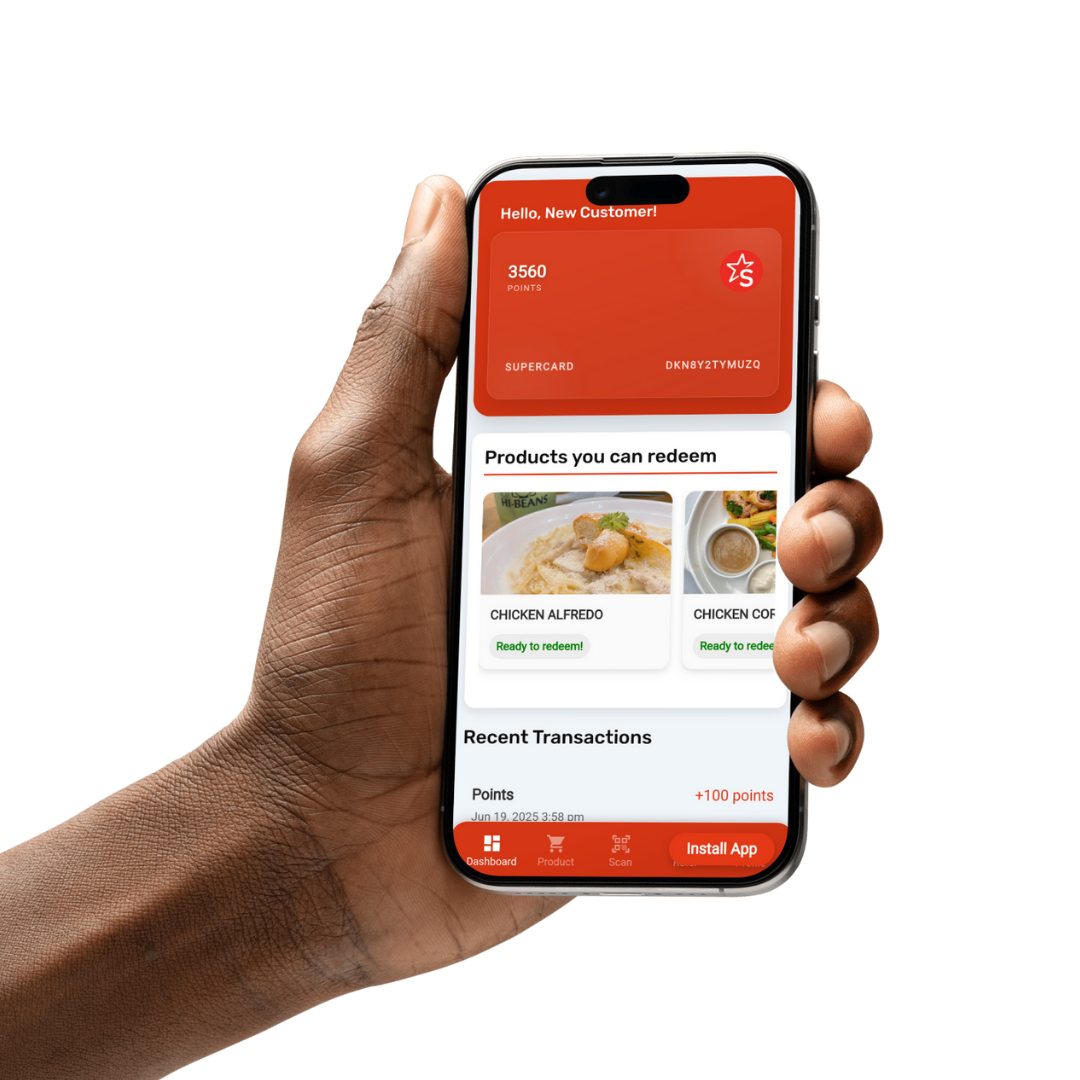

We’re witnessing a loyalty card renaissance where 68% of millennials won’t even consider brands without robust digital rewards programs according to Bond Brand Loyalty’s 2024 report. Yet the magic happens at the intersection of physical and digital experiences. Take Brew & Bites Cafe in Portland – they kept their charming cardboard punch cards but added QR codes linking to a digital stamp card app. The result? 40% more repeat visits within three months. Why does this hybrid approach work so well? Because it satisfies our psychological need for tactile rewards while delivering digital convenience. The modern loyalty card isn’t just a transactional tool; it’s a data goldmine revealing customer preferences, visit frequency, and spending patterns. Unlike old punch card systems that left businesses blind, today’s solutions like Spree Rewards transform every coffee stamp into actionable intelligence. The most successful programs leverage three key elements: instant gratification (digital tracking), tangible rewards (physical perks), and emotional connection (personalized experiences).

Did You Know? Harvard Business Review found businesses using hybrid loyalty card programs see 3x higher customer lifetime value compared to digital-only alternatives. The physical component triggers dopamine responses while digital tracking enables precision marketing.

From S&H Green Stamps to Digital Stamps: A Historical Journey

The first loyalty card program dates back to 1896 when Thomas Sperry handed out “trading stamps” at his Buffalo grocery store. But the real game-changer arrived in 1930 when the iconic S&H Green Stamps program took America by storm. Customers would collect these physical stamps with purchases, paste them into booklets, and redeem them for household goods. This analog system dominated retail for decades until the 1980s when airlines revolutionized loyalty with digital tracking through frequent flyer programs. The punch card loyalty system emerged as the small business alternative – simple, affordable, and universally understood. But these paper-based systems had fatal flaws: customers lost cards, businesses couldn’t track behavior, and fraud was rampant (ever try photocopying a filled punch card?). The 2010s brought the first wave of digital solutions, but they required expensive hardware and complex setups. Today’s stamp card apps represent the democratization of loyalty tech – cloud-based, mobile-first platforms like Spree Rewards that put enterprise-level capabilities in the hands of mom-and-pop shops.

Myth Busting: Loyalty Program Misconceptions

- Myth: Digital programs are too expensive → Reality: Cloud-based solutions cost 80% less than 2010-era POS integrations

- Myth: Older customers won’t adopt apps → Reality: 63% of seniors prefer app-based cards over physical ones (AARP 2024)

- Myth: Punch cards drive less revenue → Reality: Properly structured programs increase average ticket by 22%

The Paper Problem: Why Traditional Punch Cards Fail

While nostalgic, traditional punch card loyalty systems suffer from four fatal flaws that directly impact your bottom line. First is the “wallet share” problem – 79% of consumers admit to abandoning punch cards because they forget them at home or can’t fit more in their wallets. Second is the data black hole: when Sarah’s Sweetshop awards a free cupcake after 10 punches, they have zero insight into whether that customer visits weekly or quarterly, what other products they buy, or their lifetime value. Third is the fraud factor – a University of Retail study found 12% of punch card redemptions are fraudulent through card sharing or counterfeit punches. But the most damaging issue? Missed marketing opportunities. Consider this case study: Benny’s Burgers ran identical promotions through punch cards and a digital stamp card app. The paper version had 19% redemption while the app version achieved 63% – plus generated 287 new email subscribers for future marketing. The core insight? Physical cards create transactional relationships while digital systems build customer intelligence ecosystems.

Punch Card Problems

- Average 23% loss rate

- Zero customer insights

- No remarketing capability

- Fraud vulnerability

Stamp Card App Solutions

- Always-with-customer via phones

- Real-time analytics dashboard

- Automated email/SMS campaigns

- Secure QR code verification

The Ripple Effect: How Digital Loyalty Transforms Businesses

When you shift from punch cards to intelligent stamp card apps, the business impact cascades across every department. Sales teams see immediate lifts – a Nielsen study showed digital loyalty members spend 37% more than non-members and visit 2.9x more frequently. Marketing gains superpowers: instead of blasting generic coupons, you can send hyper-targeted offers like “Your favorite oat milk latte is $1 off tomorrow morning” based on actual purchase history. Operations improve through data-driven decisions – Sweet Scoops Ice Cream used their Spree Rewards heatmaps to discover 42% of rewards were redeemed between 8-10pm, prompting them to extend summer hours. Most importantly, customer relationships deepen. Digital systems allow for “surprise and delight” moments impossible with paper – imagine automatically upgrading a loyal customer’s coffee when they’ve hit their 15th visit in a month. The psychological impact is profound: behavioral economists find digital progress tracking (like watching your virtual stamp card fill) triggers the endowed progress effect, making customers 15% more likely to complete rewards cycles.

Step-by-Step: Calculating Your Loyalty Potential

- Track your current repeat customer rate (industry average: 32%)

- Calculate average transaction value (e.g., $8.50 for coffee shops)

- Multiply by 2.9x visit frequency lift from digital loyalty

- Add 22% average ticket increase from rewards psychology

- Example: 500 customers x $8.50 x 2.9 visits x 1.22 = $15,000+/month revenue potential

Implementation Obstacles: Avoiding Digital Loyalty Pitfalls

Transitioning from punch card loyalty to digital systems presents real challenges, but awareness prevents costly mistakes. The biggest hurdle? Adoption friction. When Cafe Luna launched their new stamp card app without staff training, redemption rates dropped 40% in the first month because baristas didn’t know how to scan QR codes. Another pitfall is reward miscalibration – offering too little (“10 coffees for 1 free? No thanks”) or too much (destroying margins). The Goldilocks principle applies: data shows 7-8 visits for a mid-value reward optimizes motivation and profitability. Technology integration headaches rank third – 34% of businesses report initial POS synchronization issues according to Retail TouchPoints. But perhaps the most dangerous mistake is “set and forget” syndrome. Unlike static punch cards, digital programs require active optimization. Avoid these pitfalls with three proven tactics: 1) Run parallel paper/digital systems during transition 2) Start with 1:8 reward ratios then adjust based on data 3) Designate a “loyalty champion” to monitor and tweak weekly.

Expert Insight: Dr. Emily Rodriguez, Behavioral Economist

“The most successful digital stamp card programs leverage variable rewards – occasional surprise bonuses alongside predictable stamps. This taps into the same psychological mechanisms that make slot machines compelling, but for positive customer engagement. A simple ‘bonus stamp Wednesday’ can increase visit frequency by 18%.”

Your Digital Transformation Roadmap: Step-by-Step Guide

Ready to upgrade from punch cards to profit-driving digital loyalty? Follow this battle-tested 5-step framework implemented by 1,200+ Spree Rewards customers. First, audit your current loyalty performance – if you’re using paper punch cards, calculate your redemption rate (industry average is just 12-15%). Second, define your “why” – are you boosting visit frequency, increasing average ticket, or gathering customer data? Third, structure your reward tiers using proven psychology: 1) Make first reward achievable quickly (5 visits) 2) Mid-tier rewards at 8 visits 3) Premium rewards at 12+ visits with bonus stamps for referrals. Fourth, choose your technology stack – look for stamp card apps offering:

- No hardware requirements (smartphone-scannable QR codes)

- Real-time analytics dashboard

- Automated marketing tools

- Free customer apps (no downloads required)

Fifth, launch with a “Double Stamps Grand Opening” promotion – our data shows this generates 3x faster adoption. Remember to train staff thoroughly – role-play customer scenarios until they can explain the program in under 15 seconds.

Ready to Transform Your Loyalty Program?

Join 8,500+ businesses using Spree Rewards’ stamp card app platform. Get started in 15 minutes with no technical skills!

Industry Insights: What Loyalty Experts Won’t Tell You

Behind the scenes, loyalty program consultants guard surprising secrets. First: points systems are dying. Punch card simplicity is making a massive comeback because consumers are fatigued by complex point calculations – 68% prefer straightforward “buy X get Y” programs (Forrester 2024). Second: The best programs aren’t about freebies but recognition. When The Book Nook started sending “Top Reader” badges in their stamp card app, engagement jumped 73%. Third: Data is the real prize. “The coffee you give away is just the cost of acquiring behavioral data,” admits loyalty architect Michael Tan. Savvy businesses use stamp card apps to identify their “whales” – the top 12% of customers generating 48% of revenue according to Pareto principle analysis. But perhaps the most controversial insight? Discounts destroy margins while experiential rewards boost them. Compare: a free $4 coffee costs you $1.20, while inviting top customers to an exclusive “after-hours mixology class” costs $8/person but generates $52 average additional spend and priceless social content.

Pro Tip: The 5:1 Engagement Rule

For every promotional message sent through your loyalty app, send five non-sales engagements. Examples: “Barista’s drink of the month,” “Behind-the-scenes bakery tour video,” or “Customer spotlight story.” This maintains relationship value beyond transactions.

The Cutting Edge: AI, Gamification & Personalization

The next wave of loyalty card innovation will make today’s stamp card apps look primitive. Artificial Intelligence now enables predictive rewards – systems that analyze individual behavior to offer personalized incentives before customers churn. Imagine your coffee app notifying: “Your usual Monday latte will be half-off tomorrow because we missed you last week.” Gamification is exploding – leaderboards, achievement badges, and challenges boost engagement by 82% when properly implemented. The most successful example? Bubble Tea Bliss saw 300% more referrals after adding “Dueling Friends” where both parties get bonus stamps when new members join. Location-based triggers represent another frontier: geofenced offers that activate when customers near your store. But the real game-changer is emotional AI integration. Pilot programs analyzing facial expressions (with consent) during rewards redemption are creating “mood-adjusted” offers – offering comforting chamomile rather than espresso to stressed customers. These technologies aren’t sci-fi – they’re already built into platforms like Spree Rewards’ enterprise suite.

Quick Win: Social Proofing

Add notifications like “Lisa just earned her free latte!” to create FOMO. Increases stamp completion by 31%.

Quick Win: Progress Bar

Visual progress indicators boost reward completion by 22%. Show stamps filling a virtual card.

Quick Win: Tiered Rewards

Offer choice at redemption: “Claim your free coffee OR upgrade to large for $0.50.” 63% choose upsell.

The 2025 Loyalty Landscape: Predictions & Preparations

As we approach 2025, three seismic shifts will redefine loyalty card programs. First, consolidation: standalone stamp card apps will become integrated “customer experience platforms” combining reservations, payments, and loyalty – think Shopify for physical retailers. Second, blockchain verification will solve the twin problems of reward fraud and data security through immutable digital ledgers. Third, and most profound: the rise of collaborative loyalty networks. Imagine earning stamps at your coffee shop that can also redeem at your bookstore, florist, and yoga studio – neighborhood business ecosystems sharing rewards programs to compete with Amazon. Forward-thinking businesses are already preparing:

- Democratizing data – giving customers transparent control over their information in exchange for better rewards

- Building community features – turning loyalty apps into social hubs where customers connect

- Implementing sustainability rewards – bonus stamps for bringing reusable cups or containers

The businesses thriving in 2025 will view loyalty not as a cost center but as their primary customer intelligence engine – and it all starts with evolving beyond paper punch cards today.

Future-Proof Your Loyalty Program

Spree Rewards’ enterprise platform includes blockchain security, neighborhood networks, and AI personalization – all accessible to small businesses.

Key Takeaways: Your Action Plan for Loyalty Dominance

The loyalty card revolution boils down to this: paper punch cards belong in museums while digital stamp card apps belong in your growth strategy. Your roadmap to loyalty dominance starts with recognizing that modern programs are data engines disguised as rewards systems. Implement these critical actions immediately:

- Phase out paper within 90 days – Run hybrid programs during transition

- Adopt cloud-based stamp card apps – Prioritize zero-download solutions

- Structure rewards using behavioral psychology – Fast first reward, variable surprises, tiered choices

- Mine your data weekly – Identify whales, detect churn risks, spot trends

- Humanize digital experiences – Staff training matters more than technology

The math is undeniable: businesses implementing intelligent loyalty programs see 27% higher retention rates and 3.1x ROI according to McKinsey. But beyond numbers, they build something priceless – a community of advocates who feel recognized, valued, and excited to engage. Your punch card system served you well, but the future belongs to dynamic, data-rich relationships.

Your 60-Second Loyalty Audit

- What percentage of customers are repeat visitors? (Goal: 45%+)

- Do you know your top 20 customers by name/spending habits?

- Can you message your loyal customers right now? (Email/SMS list)

- Is your reward cost below 15% of incremental revenue generated?

Score 3-4 “yes”? You’re ahead. Fewer? Start your digital transformation today.

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies