The Loyalty Card Revolution: How Smart Businesses Turn Occasional Buyers Into Superfans

Did you know 75% of consumers say they’re more likely to stick with brands that offer loyalty programs? Yet most businesses still treat their loyalty card programs as an afterthought – a plastic punch card collecting dust at the bottom of wallets. The truth? Your loyalty card could be your most powerful profit driver if used correctly. Take Sarah’s Café in Austin – by revamping their digital loyalty card program, they increased repeat visits by 43% in just 90 days. That’s the power of strategic rewards done right. Whether you’re a coffee shop owner or retail manager, this guide will show you exactly how to transform your loyalty card from a forgettable perk into a customer retention machine. We’ll explore psychological triggers that make rewards irresistible, break down successful case studies, and give you plug-and-play templates you can implement today.

Table of Contents

- The Psychology Behind Loyalty Card Success

- Physical vs Digital Loyalty Cards: What Works in 2025?

- How to Design a Loyalty Card Program That Actually Gets Used

- Seamless POS Integration: Making Your Loyalty Card Effortless

- The Power of Tiered Rewards (And How to Structure Them)

- Gamification Tricks That Make Your Loyalty Card Addictive

- Turning Loyalty Card Data Into Marketing Gold

- Loyalty Cards as Your Secret Retention Weapon

- 7 Deadly Loyalty Card Mistakes (And How to Avoid Them)

- The Future of Loyalty Cards: What’s Coming Next

The Psychology Behind Loyalty Card Success

Why do customers cling to some loyalty cards while others end up in the trash? It all comes down to behavioral psychology. The most effective programs tap into three powerful triggers: the endowment effect (we value what we “own”), loss aversion (we hate missing out), and goal-gradient hypothesis (we accelerate effort as we near rewards). Starbucks nails this – their app shows progress toward free drinks with visual milestones. When researchers analyzed 10,000 loyalty card programs, they found programs with visible progress tracking had 2.3x higher redemption rates. Here’s how to apply this: First, make rewards feel attainable (5 purchases not 50). Second, use progress bars or stamp cards showing advancement. Third, trigger FOMO with messages like “You’re just 2 stamps away from a free latte!” Pro tip: Digital loyalty cards like Spreerewards automatically handle these psychological nudges with built-in progress tracking and smart notifications.

Actionable Tip:

Test these psychological triggers in your loyalty card program today:

- Add a progress visualization (like coffee cup stamps filling up)

- Send “You’re close!” alerts at 80% completion

- Offer surprise bonus points for anniversary dates

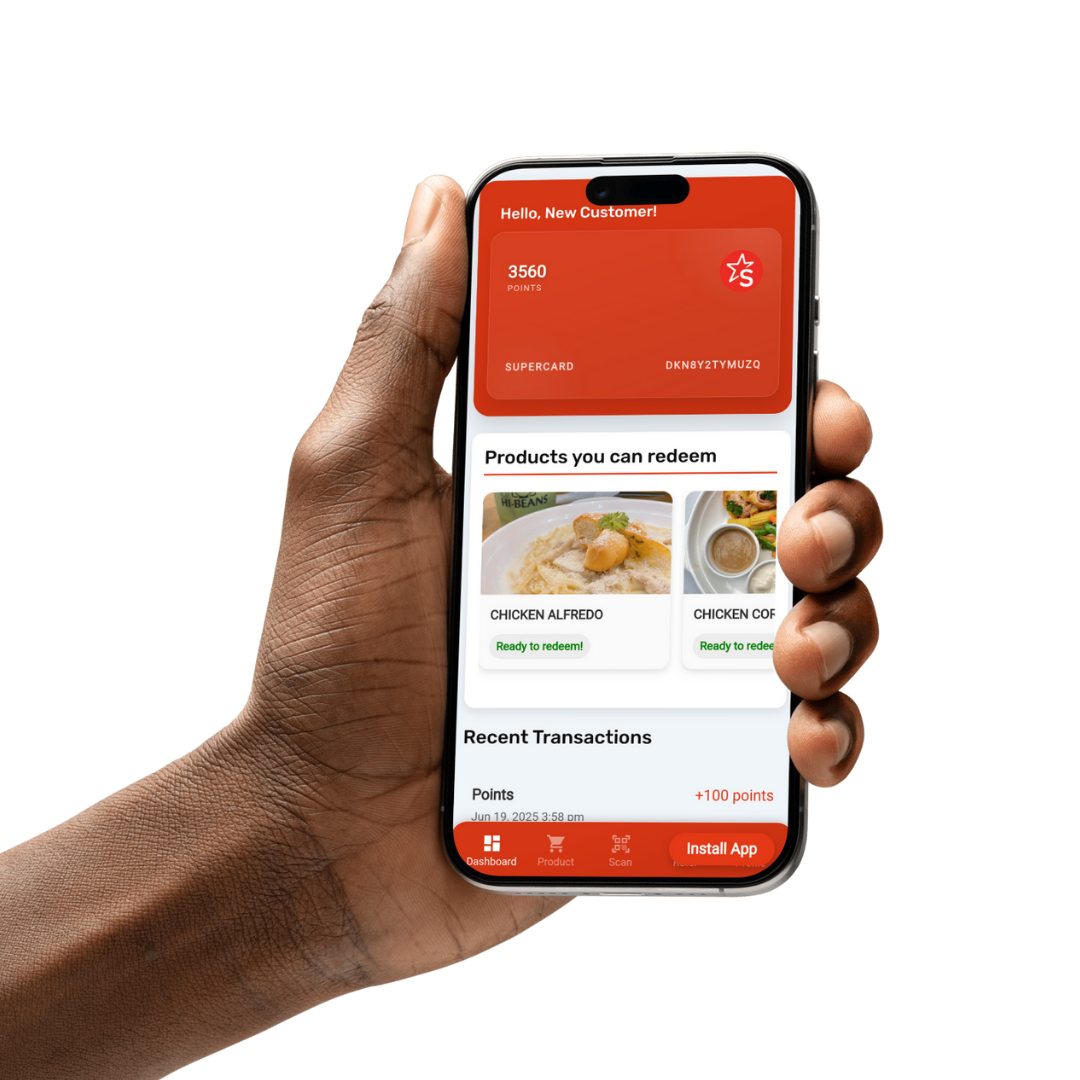

Physical vs Digital Loyalty Cards: What Works in 2025?

The loyalty card landscape has radically shifted – while 72% of businesses still use physical cards, digital adoption is growing 300% year-over-year. Physical cards have nostalgia value (think the classic coffee shop punch card), but come with huge limitations: they get lost, can’t be updated, and provide zero customer insights. Digital loyalty cards solve these problems while adding powerful features: GPS check-ins, personalized offers, and automatic redemption. Take The Brew House chain – after switching to digital loyalty cards, they saw 58% more redemptions and collected valuable purchase pattern data. The sweet spot? Many successful businesses use hybrid models: physical cards for older demographics supplemented with digital options. Key decision factors: If your customers are tech-savvy, prioritize mobile. If you serve an older crowd, maintain physical options but include QR codes that bridge to digital tracking.

How to Design a Loyalty Card Program That Actually Gets Used

Designing an effective loyalty card isn’t about fancy graphics – it’s about creating effortless value exchange. The best programs follow three design principles: simplicity (easy to understand), immediacy (quick first reward), and relevance (rewards customers actually want). Common mistake? Offering points for dollars spent rather than visits – this favors big spenders over frequent visitors. Instead, model after Sephora’s Beauty Insider: different tiers with meaningful perks (free shipping, exclusive events). For small businesses, try this proven structure: 1) Free join bonus (immediate reward), 2) Visit-based earning (not spend-based), 3) Tiered benefits that unlock at 5/10/20 visits. Pro tip: Digital loyalty card platforms like Spreerewards offer pre-built templates that automatically apply these best practices.

Seamless POS Integration: Making Your Loyalty Card Effortless

The #1 reason loyalty cards fail? Friction at checkout. If staff have to manually look up accounts or customers need to dig for cards, participation plummets. Modern solutions solve this through POS integration: customer phone numbers automatically pull up accounts, purchases auto-track points, and redemptions happen with one click. Case in point: When Sweet Cream Cafe integrated their loyalty card system with Square POS, redemption rates jumped from 12% to 39% in three months. Key integration features to look for: automatic point accrual, mobile number lookup, instant redemption processing, and receipt integration (showing points earned). If you’re not tech-savvy, no worries – most modern loyalty platforms offer plug-and-play POS integrations with major systems like Clover, Toast, and Shopify.

Pro Tip:

When evaluating loyalty card POS integration, ask these questions:

- Does it work with our existing hardware/software?

- Can customers redeem without slowing down checkout?

- Does it automatically track customer purchase history?

Most solutions offer free trials – test drive before committing.

The Power of Tiered Rewards (And How to Structure Them)

Tiered loyalty cards create VIP experiences that turn casual customers into brand advocates. The magic? Psychological commitment – once customers reach a new tier, they’re motivated to maintain status. Airlines perfected this (think Silver, Gold, Platinum), but local businesses can adapt the model. Urban Blooms flower shop increased average spend by 27% after introducing Bronze/Silver/Gold tiers with escalating perks: early access to new arrivals, free delivery thresholds, and birthday bouquets. Effective tier structures share three traits: 1) Clear progression metrics (visits or spend), 2) Meaningful (not just symbolic) benefits at each level, 3) Status visibility (badges or special cards). Warning: Don’t create too many tiers – 3-4 levels is the sweet spot for most small businesses. Want inspiration? Check out how Spreerewards helps businesses implement tiered programs with automated tracking and communications.

Gamification Tricks That Make Your Loyalty Card Addictive

Gamification transforms mundane transactions into engaging experiences. The most addictive loyalty cards borrow from game design: progress bars, surprise rewards, and friendly competition. Dunkin’ saw 21% more app engagement after adding “Streak” counters for consecutive visits. Easy gamification tactics you can implement tomorrow: 1) “Spin the wheel” bonus points after every 5th purchase, 2) Limited-time double point weekends, 3) Leaderboards showing top customers (with permission). Psychology tip: Variable ratio reinforcement (unpredictable rewards) creates stronger habits than fixed systems – occasionally give random bonus points to keep customers guessing. Digital loyalty platforms make gamification easy with built-in features like achievement badges and challenge campaigns that you can activate with one click.

Turning Loyalty Card Data Into Marketing Gold

Your loyalty card program isn’t just giving away freebies – it’s building a goldmine of customer intelligence. Every redemption and purchase reveals preferences, visit frequency, and spending habits. Smart businesses use this data to: personalize offers (send a free pastry to coffee regulars), optimize inventory (stock favorites of top-tier members), and identify at-risk customers (declining visit frequency). For example, Brew & Bites analyzed loyalty data to discover 68% of members preferred afternoon visits – they shifted happy hour specials accordingly, boosting revenue 19%. Key metrics to track: redemption rate (aim for 25%+), average time between visits, and tier distribution. Modern loyalty card software automatically generates these insights – no spreadsheet skills required.

Loyalty Cards as Your Secret Retention Weapon

In an era of endless choices, your loyalty card creates switching costs that keep customers coming back. The numbers don’t lie: businesses with strong loyalty programs retain 47% more customers than those without. But true retention power comes from emotional connection, not just points. Tactics that build emotional loyalty: 1) Celebrate member anniversaries (“Thanks for 1 year with us!”), 2) Offer exclusive experiences (invite-only tasting events), 3) Surprise-and-delight moments (random upgrades). Pet Pantry saw 92% renewal rates after adding birthday treats for members’ pets to their program. Remember: Your loyalty card should feel like club membership, not a transaction ledger. This emotional layer is what transforms satisfied customers into vocal advocates who bring friends.

Success Story:

“After implementing a digital loyalty card with Spreerewards, we saw our customer retention rate jump from 31% to 67% in six months. The automated birthday rewards alone generated $12,000 in incremental revenue.”

– Maria Chen, Owner of Daily Grind Coffee

7 Deadly Loyalty Card Mistakes (And How to Avoid Them)

Even well-intentioned loyalty cards fail when they commit these cardinal sins: 1) Overcomplicating rules (if customers can’t explain it, they won’t use it), 2) Making rewards too distant (25 purchases for a free coffee?), 3) Not promoting the program (60% of customers won’t ask about it), 4) Generic rewards ($5 off isn’t exciting), 5) No expiration (eliminates urgency), 6) Ignoring inactive members (reactivation campaigns work), 7) Not training staff (they’re your ambassadors). The fix? Keep it simple, reward often, promote constantly, personalize perks, create deadlines, re-engage dormants, and educate employees. Digital loyalty card systems help avoid these pitfalls with pre-configured best practices and automated member communications.

The Future of Loyalty Cards: What’s Coming Next

The loyalty card evolution is accelerating: expect AI-powered personalization (systems that predict optimal rewards for each customer), blockchain-based universal points (transferable between businesses), and AR experiences (scan your card to unlock digital content). Early adopters are already testing “social loyalty” where customers earn points for referrals and social shares. The throughline? Frictionless, personalized, and experiential rewards that transcend transactional relationships. While tech will advance, the core principle remains: customers join for the rewards but stay for the recognition and belonging. Businesses that master this balance will own the future of customer retention.

Frequently Asked Questions

How much does a loyalty card program typically cost?

Costs vary dramatically based on complexity. Physical punch cards can cost under $0.50 each, while digital solutions typically charge $50-$300/month for small businesses. The ROI justifies it – businesses average $5.60 return for every $1 spent on loyalty programs. Many platforms like Spreerewards offer free starter plans with basic features, making it easy to test before scaling.

What’s the ideal number of purchases needed for a free reward?

Psychological research shows 5-10 purchases is the sweet spot for visit-based rewards. For spend-based programs, aim for customers to earn a meaningful reward after 15-20% of their average annual spend with you. The key is balance – rewards should feel achievable but require meaningful engagement.

How do I get customers to actually sign up for my loyalty card?

Successful programs use a combination of incentives (instant first reward), ease (30-second signup), and visibility (table tents, register prompts). Top tactic: Have staff personally invite customers during checkout with a specific benefit (“Join now and your next coffee is on us”). Digital signups via QR codes can boost enrollment by 70% over paper forms.

Should my loyalty program be points-based or visit-based?

Visit-based works better for frequent, low-cost purchases (coffee shops). Points-based (where dollars spent = points) suits businesses with variable purchase amounts (retail stores). Hybrid models are increasingly popular – base rewards on visits but offer bonus points for dollar thresholds or specific items.

How often should I refresh my loyalty card offers?

Rotate bonus incentives quarterly (like double points weekends) but keep core structure consistent. Customers need stability in how they earn, but novelty in how they can accelerate rewards. Analyze redemption data – if participation drops, it’s time to refresh perks.

Can small businesses really compete with big-brand loyalty programs?

Absolutely! While you can’t match Starbucks’ scale, you can offer something more valuable – personal recognition. 68% of consumers say personalized service matters more than points. Know customers’ names, remember their orders, and tailor rewards – these human touches beat corporate programs every time.

Ready to Transform Your Business With Smarter Loyalty?

In just 15 minutes, you could have a professional loyalty card program driving repeat visits and increasing customer spend. Don’t let complicated setups hold you back – modern solutions make it effortless.

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies