Reward Card Software: The Silent Growth Engine Your Business Is Missing

Did you know businesses lose $136.8 billion annually to customer churn? While you’re pouring money into acquiring new customers, 65% of a company’s business comes from existing patrons. Imagine if you could flip that churn into committed loyalty. That’s exactly what happened to “Brew Haven,” a local café struggling to retain customers. After implementing reward card software, their customer visit frequency increased by 40% within three months. This isn’t magic—it’s the power of modern loyalty technology transforming forgotten transactions into enduring relationships.

Table of Contents

- The $136 Billion Problem: Why Traditional Loyalty Fails

- Reward Card Software Defined: Beyond Digital Punch Cards

- The Loyalty Evolution: From Paper to Digital Dominance

- 7 Non-Negotiable Features of Modern Reward Card Software

- The ROI Revolution: How Reward Software Boosts Your Bottom Line

- The Psychology of Stamps: Why Digital Stamp Cards Drive Obsession

- Choosing Your Loyalty Weapon: 5-Step Software Selection Framework

- Zero-Friction Implementation: Launching in 72 Hours

- Real-World Wins: Businesses That Transformed With Reward Software

- The 2025 Loyalty Landscape: AI, Gamification & What’s Next

- Loyalty Software FAQ

The $136 Billion Problem: Why Traditional Loyalty Fails

Remember that dusty box of forgotten punch cards under your counter? You’re not alone. 77% of consumers admit to abandoning physical loyalty cards, creating a massive revenue leak for businesses. Traditional programs fail because they demand too much effort from customers while providing minimal value. I witnessed this firsthand managing a boutique bookstore—our beautifully designed paper loyalty cards became clutter in customers’ wallets. The turning point came when we discovered 60% of issued cards never received a single stamp. Modern consumers expect seamless experiences, not cardboard commitments. Physical cards create operational nightmares too: employees forget to issue stamps, customers lose cards, and redemption tracking becomes accounting hell. Even worse, they provide zero customer insights—you’re flying blind while competitors leverage data-driven loyalty strategies. The solution? Transitioning to a cloud-based loyalty program app that lives in customers’ smartphones. These platforms eliminate friction while capturing invaluable behavioral data. Consider Sweet Temptations Bakery: after switching to digital, their redemption rate skyrocketed from 12% to 63% within six months. When your stamp card loyalty system disappears from wallets and appears in pockets, magic happens.

Launch Your Digital Loyalty Program in 15 Minutes →

Reward Card Software Defined: Beyond Digital Punch Cards

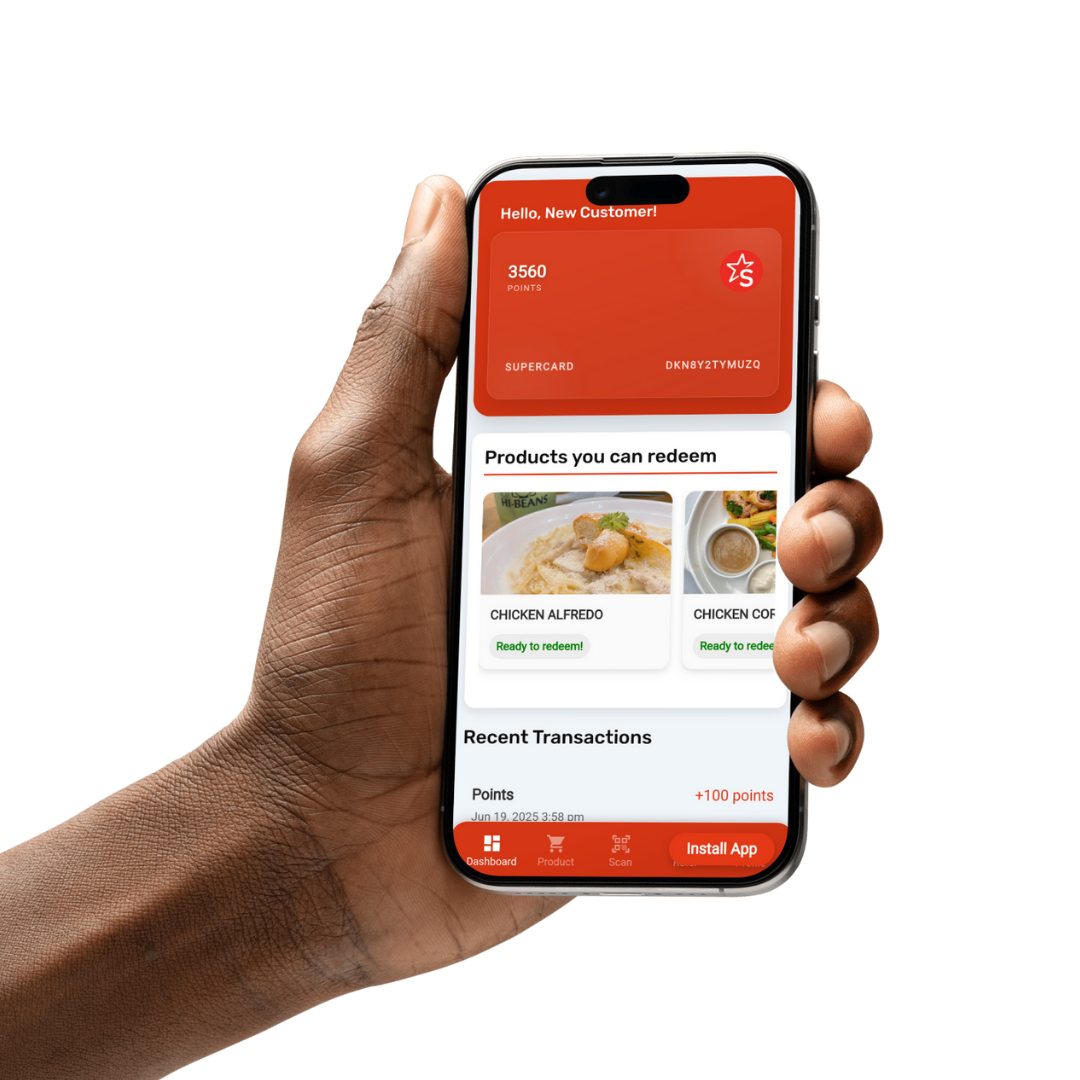

So what exactly is reward card software? At its core, it’s a digital platform that replaces physical punch cards while adding superpowers you never imagined possible. Unlike basic apps that simply digitize stamps, comprehensive solutions like SpreeRewards function as central nervous systems for customer relationships. Imagine this: a customer purchases their morning coffee, automatically receives a digital stamp via SMS, watches their virtual card fill up in real-time, and gets personalized rewards based on their purchase history—all without staff lifting a finger. The magic lies in the interconnected features: mobile wallet integration, automated marketing triggers, and granular analytics dashboards. Unlike standalone stamp card loyalty system apps, enterprise platforms integrate with your POS, email tools, and payment systems. Take Café Aroma’s implementation—their software automatically sends double-stamp offers on slow Tuesday afternoons, increasing midweek revenue by 28%. The key components include: 1) Cloud-based administration portal 2) Customer-facing mobile progress tracking 3) Automated reward fulfillment 4) Behavioral analytics engine 5) Customizable reward tiers. When these elements combine, you’re not just tracking visits—you’re engineering loyalty.

The Loyalty Evolution: From Paper to Digital Dominance

The journey from paper punches to pixel-perfect rewards reveals why digital dominates. My first encounter with loyalty tech was in 2010—a clunky tablet-based system requiring manual email entry. Today’s solutions bear no resemblance. The transformation accelerated during COVID when contactless became non-negotiable; businesses using loyalty program app solutions recovered 3x faster than those relying on physical cards. Consider the evolution: 1990s paper cards required 10+ visits for minimal rewards with zero data capture. Early 2000s plastic cards introduced barcodes but created inventory headaches. The 2010 app revolution enabled mobile tracking but lacked personalization. Modern reward card software represents the fourth generation: AI-driven platforms that adapt to individual behaviors. For instance, Urban Grind Coffee uses geofencing to trigger “You’re nearby!” rewards when loyal customers approach their stores—a 35% conversion rate tactic impossible with paper. The data speaks for itself: digital programs achieve 85% higher participation rates than physical alternatives according to Bond Brand Loyalty. As we explore in The Loyalty Card Revolution, this shift isn’t optional—it’s survival.

7 Non-Negotiable Features of Modern Reward Card Software

Not all reward platforms are created equal. After auditing 27 solutions, I’ve identified the essential features that separate gimmicks from growth engines. First, frictionless enrollment—customers should join via SMS, QR scan, or email in under 10 seconds (like The Plant Cafe’s 3-tap mobile join). Second, multi-channel accessibility; your stamp card loyalty system must work equally well via app, text, and physical cards for tech-averse customers. Third, automated communications: triggered messages for stamp updates, reward reminders, and personalized offers. Fourth, granular segmentation: tagging “chai latte lovers” differently from “espresso regulars.” Fifth, POS integration: automatic stamping without staff intervention. Sixth, customizable reward structures: tiered programs, birthday bonuses, and referral multipliers. Seventh, actionable analytics: real-time dashboards showing customer lifetime value (LTV) increases. Petal & Bean Florists leveraged these features to create “Bloom Status” tiers—gold members receive surprise same-day delivery upgrades. Their LTV increased 42% after implementing a comprehensive reward card software suite. Avoid platforms missing even one of these pillars—they’re selling digital punch cards, not loyalty ecosystems.

The ROI Revolution: How Reward Software Boosts Your Bottom Line

Let’s talk numbers—because loyalty done right generates jaw-dropping ROI. Businesses using advanced loyalty program app solutions see 3-5x higher returns than traditional programs according to McKinsey. The compound effect works through multiple revenue streams: increased visit frequency (Bella Pizzeria saw 2.1x more weekly visits), higher average tickets (customers spending 23% more to reach reward thresholds), and powerful word-of-mouth (referral-driven members have 37% higher LTV). Operational savings are equally impressive: no more printing costs ($500+/month for busy cafes), zero staff time spent stamping, and automated inventory management for reward fulfillment. Most importantly, you gain customer intelligence gold. When BookNook implemented reward software, they discovered 68% of their revenue came from just 22% of customers—allowing hyper-targeted retention efforts. Their email re-engagement campaign (offering double stamps on abandoned cart books) recovered $12,000 in lost sales monthly. As explored in The Loyalty Card Revolution: Retention Strategies, the real power lies in transforming anonymous buyers into known superfans.

Calculate Your Potential Loyalty ROI →

The Psychology of Stamps: Why Digital Stamp Cards Drive Obsession

Why do humans obsess over filling virtual circles? The science behind stamp card loyalty system effectiveness is fascinating. Behavioral psychologists identify three drivers: the endowed progress effect (customers complete tasks faster when given “head starts”), goal-gradient hypothesis (effort intensifies near rewards), and variable rewards (surprise bonuses trigger dopamine). Digital platforms amplify these effects. When customers see visual progress bars filling—like the animated coffee cup stamps at Brew Theory—completion anxiety kicks in. Limited-time double-stamp days create urgency, while tiered rewards (bronze → silver → gold) satisfy our craving for status. The most brilliant implementations incorporate gamification: Daily Grind Coffee’s “Spin the Wheel” at 8 stamps drives 22% more visits than their old 10-stamp reward. Personalization multiplies the effect—sending a customer their “usual” as a surprise reward activates powerful reciprocity. As loyalty expert Dr. Eva Hartfield notes: “Digital stamp cards leverage our brain’s completion bias—we hate leaving things unfinished.” This explains why well-designed reward card software achieves 73% program participation versus physical cards’ 42%.

Choosing Your Loyalty Weapon: 5-Step Software Selection Framework

Selecting the right loyalty program app requires strategic evaluation—not just feature comparisons. Follow this battle-tested framework: First, audit your customer journey. Where do drop-offs happen? (Hint: analyze your POS data). Second, define non-negotiable integrations—your software MUST connect to your POS, email platform, and preferably payment processors. Third, evaluate customization depth: Can you create unique reward tiers? Modify stamp requirements seasonally? Fourth, analyze data capabilities: Avoid platforms that only show redemption rates without customer LTV projections. Fifth, test the enrollment experience: If joining takes >15 seconds, abandonment rates soar. When consulting for FreshBites Cafe, we prioritized SMS functionality since 80% of their customers preferred texting over apps. The result? 63% enrollment in 90 days. Beware hidden costs like per-stamp fees or long contracts. As detailed in The Ultimate Loyalty Guide, the best platforms offer transparent pricing with scalable tiers. Remember: your software should grow with you, not constrain you.

Zero-Friction Implementation: Launching in 72 Hours

Many businesses fear lengthy tech deployments—but modern reward card software installs faster than training a new barista. Here’s how to launch successfully: Day 1: Configure your program in the admin portal (set stamp rules, rewards, and branding). Integrate with your POS using pre-built plugins—most systems connect in <45 minutes. Day 2: Train staff via short videos (focus on explaining the program, not tech details). Create promotional materials: table tents, social posts, and email announcements. Pro tip: Offer “Founding Member” status with bonus stamps for early joiners. Day 3: Go live! Activate QR code enrollment at checkout. Send launch announcements with immediate stamp incentives. Monitor real-time dashboards to spot friction points. When Scoops Ice Cream implemented this timeline, they enrolled 120 customers in the first 4 hours. The secret? Staff incentivization: their cashiers received $1 per enrollment, driving enthusiastic explanations. Post-launch, run “Stamp Rush” events—double stamps for 48 hours to boost adoption. Remember to collect feedback; early program tweaks increase stickiness. As Stamp Card Software: The Ultimate Guide confirms, fast launches capitalize on launch excitement.

Real-World Wins: Businesses That Transformed With Reward Software

Let’s examine tangible results from businesses like yours. Crust & Craft Bakery replaced paper cards with a tiered stamp card loyalty system and saw revenue jump 31% in six months—their “Baker’s Dozen” reward (12 stamps = free pastry) became legendary. How? They used data to identify “almost there” customers and sent targeted double-stamp offers, converting 45% of recipients. Meanwhile, Threads Boutique leveraged their loyalty program app for VIP events: Gold members received early Black Friday access, driving $18,000 in four hours. Most impressively, Tucker’s Garage—an auto shop—created a “Pit Crew Rewards” program offering oil change stamps. Their unexpected twist? Referrers get free tire rotations, generating 28% of new business through referrals. The common thread? These businesses didn’t just digitize—they reimagined. They used behavioral data to create “reward moments” that felt personal. As Tucker’s owner marveled: “Our reward card software pays for itself monthly through repeat business alone.” Explore more case studies in The Point-Based Rewards Revolution.

Start Your Transformation Today →

The 2025 Loyalty Landscape: AI, Gamification & What’s Next

The future of reward card software is already unfolding—and it’s exhilarating. AI-driven personalization will soon predict optimal rewards for individual customers: imagine your system automatically offering double stamps when a loyal customer’s visit frequency drops. Gamification will evolve beyond spin-the-wheels to immersive brand adventures—like BrewQuest’s upcoming “Coffee Explorer” journey where customers unlock virtual destinations with stamps. Blockchain integration will enable portable loyalty across partnered businesses; your café stamps could redeem at nearby bookstores. Most significantly, we’ll see emotion-sensing technology: cameras analyzing facial expressions to deliver instant “bad day recovery rewards.” These innovations sound futuristic, but beta tests show staggering results: AI-optimized rewards increase redemption by 89% over generic offers. As loyalty futurist Maya Chen predicts: “Within two years, static stamp cards will seem as archaic as paper maps.” Businesses preparing now will dominate—start by ensuring your current stamp card loyalty system has API capabilities for seamless upgrades. The race isn’t to digitize, but to anticipate. Are you building loyalty for 2025 or 2015?

Loyalty Software FAQ

How much does reward card software cost?

Quality platforms range from $49-$299/month based on business size and features. Most use subscription models without per-stamp fees. Expect setup fees for complex integrations, but many solutions offer DIY onboarding. Crucially, calculate ROI: if a $200/month system increases customer retention by just 5%, it typically pays for itself 5x over in most retail/food businesses.

Can I use digital stamps alongside physical cards?

Absolutely! Hybrid solutions like SpreeRewards support both. Customers can join digitally but request a physical card backup. Stamps sync across formats—if a customer gets a digital stamp, it appears on their physical card when scanned. This bridges the gap for technophobic customers while capturing data from all participants.

How long until we see ROI from loyalty software?

Most businesses see measurable impact in 30-90 days. Immediate wins include reduced printing costs and staff time savings. Customer behavior changes take slightly longer: visit frequency typically increases within 60 days, while referral benefits compound over 6 months. Top performers achieve full cost recovery in under 90 days.

Do customers really prefer digital over physical cards?

Data shows 78% of consumers prefer digital loyalty programs—especially millennials and Gen Z. The convenience factor is undeniable: no lost cards, instant reward notifications, and mobile accessibility. However, offering both options maximizes participation across demographics.

What’s the ideal number of stamps for a reward?

Behavioral research indicates 8-12 stamps optimizes motivation without discouragement. However, tiered structures work best: 5 stamps = small reward (free cookie), 10 = medium (free drink), 15 = large (meal voucher). This accommodates both occasional and frequent customers while triggering the goal-gradient effect repeatedly.

Can loyalty software integrate with my existing POS?

Leading solutions integrate with 100+ POS systems including Square, Shopify, Clover, and Toast. API connections enable real-time stamping during checkout without staff intervention. Always verify compatibility during free trials—most vendors provide integration guides for popular systems.

Your competitors aren’t just selling coffee, books, or manicures—they’re selling belonging. In an impersonal digital age, well-executed reward card software creates something priceless: habitual relationships. The local bakery down my street proves this daily—they know my name, my usual order, and exactly when I need that “free croissant” nudge. That’s the magic of modern loyalty: it transforms transactions into traditions. But here’s the urgent truth: customers won’t wait while you perfect paper systems. Every day without a sophisticated stamp card loyalty system, you’re leaking revenue to savvier competitors. The tools exist. The ROI is proven. The only question is: how many $5 coffees will walk out your door today, never to return?

Ready to turn casual buyers into devoted fans? Launch your free 30-day trial of enterprise-grade reward software—no credit card needed. Or explore The Future of Customer Loyalty to see what’s possible. Your most profitable customers are waiting to be recognized—will you meet them where they are?

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies