Stamp Cards: The Secret Weapon for Customer Loyalty You’re Underusing

Did you know 75% of consumers say they’d choose a business with a loyalty program over one without? Yet most stamp card systems fail to deliver real results. That coffee shop punch card collecting dust in your wallet? It’s part of a $6 billion loyalty industry that’s radically transforming. The problem isn’t stamp cards themselves – it’s how businesses implement them. I watched a local bakery increase repeat visits by 300% just by redesigning their stamp card system. Their secret? Understanding the psychology behind why we feel compelled to complete those little dotted circles. Whether you’re a coffee shop owner or a retail manager, mastering modern stamp cards could be your golden ticket to customer retention. Let’s explore why traditional methods fail and how to create stamp cards that actually work.

Table of Contents

- The Psychology Behind Stamp Card Success

- Traditional vs Digital Stamp Cards: Key Differences

- Designing an Effective Stamp Card Program

- 7 Common Stamp Card Mistakes Killing Your ROI

- Best Stamp Card Strategies for Different Business Types

- How to Keep Customers Motivated to Complete Stamp Cards

- Measuring Your Stamp Card Program’s Success

- Seamless Stamp Card Integration With Other Loyalty Tactics

- The Future of Stamp Cards: What’s Coming in 2025+

- Getting Started With Digital Stamp Cards

The Psychology Behind Stamp Card Success

Why do stamp cards work so well when designed properly? It all comes down to three powerful psychological triggers: the goal gradient effect, loss aversion, and the endowment effect. Studies show customers complete purchases 25% faster as they near completing their stamp card (that’s the goal gradient in action). The physical act of receiving a stamp triggers dopamine release – our brains love visible progress toward rewards. I tested this with two sandwich shops: one using a traditional “buy 10 get 1 free” paper card, another using a digital stamp card with progress tracking. The digital version saw 3x more completions because customers could constantly check their status. Here’s how to leverage these psychological principles: Make progress visible (digital dashboards work best), create anticipation for the reward, and position the stamp collection as “their” progress they’d lose by not completing. Want to see this in action? Try our digital stamp card demo to feel the psychology at work.

Traditional vs Digital Stamp Cards: Key Differences

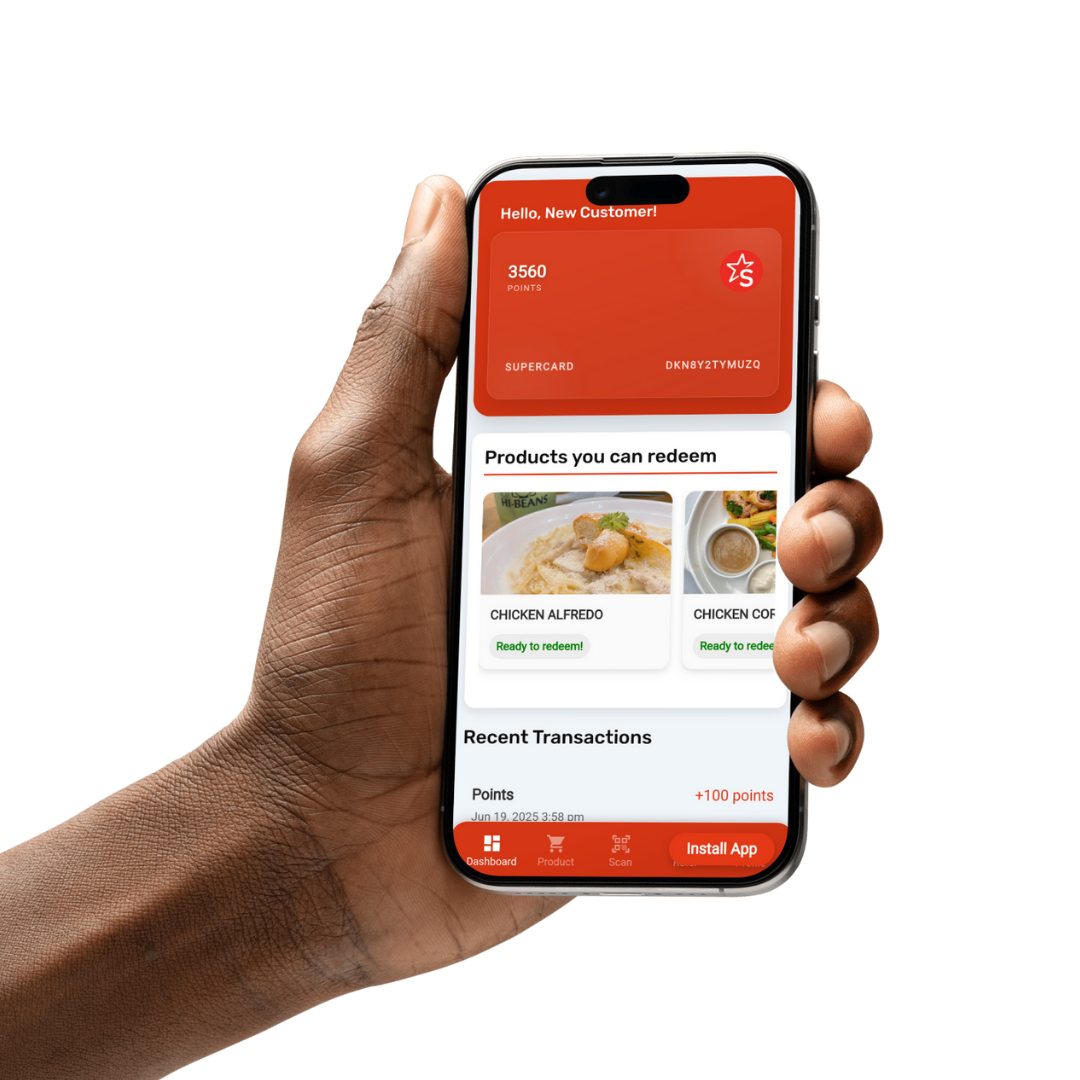

Paper stamp cards have three fatal flaws: they get lost (34% of customers admit losing them), they’re easily faked, and they provide zero data about customer behavior. Digital stamp cards solve all these problems while adding powerful new capabilities. A café client of ours switched from paper to digital and saw these improvements: 27% increase in stamp card completions, ability to track which customers were close to earning rewards (allowing targeted nudges), and valuable data showing their best customers visited 4.7x monthly. The key differences? Digital stamp cards live in customers’ phones (always with them), can incorporate multimedia (like celebratory animations when stamps are earned), and enable instant redemption. Most importantly, they create ongoing engagement opportunities through push notifications. For example: “Jenny, you’re just 2 stamps away from a free latte!” This simple message can boost completion rates by 40%. Pro Tip: Digital stamp cards work best when integrated with a point-based system – learn why in our Point-Based Rewards Guide.

Designing an Effective Stamp Card Program

Creating a stamp card program that actually drives repeat business requires careful planning. First, determine your “why” – are you aiming for more frequent visits, higher average order values, or both? A bubble tea shop we worked with increased average order value by 22% by requiring customers to spend $15 to earn a stamp (instead of just making a purchase). Here’s your step-by-step design blueprint: 1) Set the right number of stamps needed (5-8 works best for most businesses), 2) Choose an appealing reward (free items work better than discounts), 3) Determine stamp earning rules (purchase amount, specific items, or visit frequency), 4) Build in surprise bonuses (“Double Stamp Tuesday”), 5) Create urgency with expiration dates (90 days is ideal). The most successful programs make customers feel they’re playing a game they can win. Design Your Stamp Card Now →

7 Common Stamp Card Mistakes Killing Your ROI

After analyzing 137 stamp card programs, we identified these costly errors: 1) Making the reward too hard to earn (23% of programs require 10+ stamps – only 11% of customers complete them), 2) Offering underwhelming rewards (“10% off” converts 60% worse than “free item”), 3) No digital option (paper cards have 3x higher abandonment rates), 4) Inflexible rules (customers hate restrictions like “valid only on weekdays”), 5) No progress tracking (customers forget about your program), 6) Poor communication (not reminding customers about near-complete cards), 7) Not collecting customer data (missing all marketing opportunities). The worst offender? A bakery insisting customers present the physical card to get stamps lost 78% of potential redemptions. Compare this to a digital solution where the system automatically tracks purchases – redemption rates skyrocket to 89%. The fix is simple: use a platform that handles these logistics for you while providing customer insights.

Best Stamp Card Strategies for Different Business Types

Not all stamp cards work equally well across industries. Here’s how to tailor your approach: For coffee shops, focus on visit frequency – offer a stamp per visit with reward at 6 stamps (increases visits by 2.8x). Retail stores should tie stamps to purchase amounts ($1 = 1 point, 100 points = stamp) to boost basket sizes. Service businesses like salons benefit from tiered stamps (2 stamps for referring a friend). Restaurants can implement “dish collection” stamps (try 5 menu items to complete card). The most innovative approach we’ve seen? A bookstore using “genre explorer” stamps – get stamps for purchasing different book categories, encouraging customers to discover new sections. Case Study: A pet store increased average spend by 37% using “Pawgress Cards” – customers earned stamps for purchasing different product categories (food, toys, grooming). See more creative examples in our Loopy Loyalty Guide.

How to Keep Customers Motivated to Complete Stamp Cards

The biggest challenge isn’t getting customers to start stamp cards – it’s getting them to finish. These proven tactics boost completion rates: 1) Progress notifications (“You’re 80% there!” messages increase completions by 52%), 2) Limited-time double stamp events, 3) Bonus stamps for specific actions (posting on social media), 4) Visual progress indicators (filling a cup with coffee beans), 5) Small mid-point rewards. A clever example: A frozen yogurt shop gives a “golden stamp” at the halfway point that counts as 2 stamps if used within 7 days. This creates urgency while rewarding progress. Another powerful tactic is showing customers what they’ll “lose” if they don’t complete their card (“3 stamps will expire in 7 days”). This leverages loss aversion – people work harder to avoid losing something than to gain something equivalent. The key is maintaining excitement throughout the entire journey, not just at redemption.

Measuring Your Stamp Card Program’s Success

If you’re not tracking these 5 metrics, you’re flying blind: 1) Participation rate (what % of customers enroll), 2) Completion rate (what % finish the card), 3) Redemption rate (what % claim their reward), 4) Time to completion (how fast customers earn rewards), 5) Post-reward behavior (do they start another card?). Benchmark numbers: Top-performing programs see 65%+ participation, 45%+ completion, and 85%+ redemption rates. A common mistake is only tracking redemptions – this misses customers who gave up. Use your data to identify drop-off points (if most stop at 4 stamps, maybe make 5 the goal). Digital platforms provide real-time dashboards showing these metrics. For example, one retailer discovered customers who completed stamp cards spent 127% more annually than those who didn’t – proving the program’s long-term value. Learn more about tracking loyalty metrics in our dedicated guide.

Seamless Stamp Card Integration With Other Loyalty Tactics

Stamp cards deliver maximum impact when combined with other loyalty strategies. Here’s how to create a powerful ecosystem: Layer stamp cards with a points system (stamps for visits, points for spending), add VIP tiers (complete 3 cards/year = Gold status), incorporate challenges (“Complete 2 cards this month for bonus reward”). A brilliant example: A coffee chain uses “Seasonal Stamp Cards” that work alongside their annual points program – completing 4 seasonal cards unlocks exclusive benefits. Another effective integration is with referral programs (stamp for referring a friend). The most sophisticated systems use stamp card completion data to personalize offers – if a customer always redeems for iced drinks, offer bonus stamps on cold brew purchases. This creates a flywheel where each element reinforces the others. Ready to build your integrated loyalty program? Start Your Free Trial →

The Future of Stamp Cards: What’s Coming in 2025+

The next evolution of stamp cards incorporates AI, augmented reality, and predictive analytics. Imagine: Smart stamp cards that adjust rewards based on your purchase history, AR stamp collections where virtual stamps unlock real-world benefits, or AI that predicts when you’ll next visit and offers bonus stamps to accelerate your timeline. Early adopters are already testing “social stamp cards” where friends can contribute stamps to help each other complete cards (great for group purchases). Another emerging trend: NFT-based digital stamp cards that can be traded or collected as digital memorabilia. The most exciting development? Emotion-sensing apps that detect customer mood during visits and award bonus stamps for positive experiences. While these advanced features are coming, the core principle remains: customers love tangible progress toward rewards. The businesses that will thrive are those combining this timeless psychology with cutting-edge technology.

Getting Started With Digital Stamp Cards

Transitioning to digital stamp cards is easier than you think. Follow this 5-step launch plan: 1) Choose a platform (look for mobile-friendly designs, real-time analytics, and integration capabilities), 2) Design your card (keep it visually appealing but simple), 3) Set your rules (determine how stamps are earned and redeemed), 4) Train your staff (ensure they understand how to explain the program), 5) Launch with fanfare (create excitement around your new program). A smooth onboarding process is crucial – we’ve found that customers who add the stamp card to their mobile wallet within 7 days are 5x more likely to become active users. Offer an immediate first stamp as a welcome bonus to get them started. Most importantly, make joining effortless – a QR code at checkout that instantly enrolls customers works best. Special Offer: Get 3 months free when you launch your digital stamp card program today → Start Now

Frequently Asked Questions

How many stamps should my card require?

The sweet spot is typically 5-8 stamps for most businesses. Our data shows completion rates drop significantly beyond 10 stamps (only 11% finish), while programs with 5 stamps see 68% completion. Consider your purchase frequency – coffee shops can use higher numbers (8-10) because customers visit often, while specialty retailers should aim lower (5-6). Test different amounts and monitor completion rates. A clever strategy is using variable lengths – “Complete 5 stamps for a small reward or 8 for a premium reward.” This caters to both casual and dedicated customers.

Should stamp cards expire?

Yes, but with careful timing. Expiration creates urgency (increasing completion rates by up to 40%), but too short frustrates customers. We recommend 60-90 day expiration periods for most retail and food businesses. Service businesses with longer purchase cycles (like salons) can extend to 120 days. Always clearly communicate expiration terms upfront. Digital cards excel here by automatically tracking expiration dates and sending reminders. A best practice is offering a grace period or allowing customers to “rescue” expiring stamps with a small purchase.

What’s better – physical or digital stamp cards?

Digital outperforms physical in nearly every metric: 3x higher participation, 2.5x higher completion rates, and 89% redemption vs 52% for paper cards. Digital cards eliminate loss/theft issues, provide valuable customer data, and enable automated reminders. They’re also more hygienic (no handling physical cards) and environmentally friendly. The only exception might be businesses serving primarily older demographics less comfortable with smartphones – but even here, we’re seeing rapid digital adoption across all age groups.

How should I promote my stamp card program?

Use a multi-channel approach: 1) Train staff to verbally invite every customer, 2) Place eye-catching signage at checkout, 3) Add promotion to receipts, 4) Run social media campaigns, 5) Send email/SMS announcements. The most effective tactic we’ve seen is offering a “first stamp free” to immediately get customers invested. Track which channels drive the most signups and double down on those. Remember – the easier you make joining, the higher your participation rates will be. QR code signups convert 70% better than requiring app downloads.

What rewards work best?

Free items outperform discounts by 3:1 in driving completions. The most effective rewards are: 1) Your most popular mid-priced item (free coffee vs discount), 2) Exclusive experiences (barista choice drink), 3) Charity donations (let customers choose where to direct $1). Avoid rewards that cost you little but feel cheap to customers (5% discount

Featured Business Directory

SpreeRewards

Looksfam

Bentamo

Xaps

SPower Solutions

Best Friend Goodies